posted by Adam Turnquist, Chief Technical Strategist

Like clockwork, the arrival of spring has awoken the bears from a deep winter slumber. The silencing 10% first-quarter S&P 500 rally was interrupted by alarm over escalating geopolitical conflicts in the Middle East, reduced rate cut expectations, and surging interest rates as confidence in the Federal Reserve’s (Fed) battle against inflation was shaken. Equity markets reacted by pulling back from overbought levels, while Treasury yields rerated significantly higher. Sentiment followed price, and bears woke up from hibernation this month.

Since 1987, the American Association of Individual Investors (AAII) has surveyed its members each week with a simple question: “Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?” The bullish, bearish, and neutral percentage readings provide a temperature gauge for risk appetite among investors. Investors also use the readings as contrarian indicators when bullish and bearish sentiment reaches extremes.

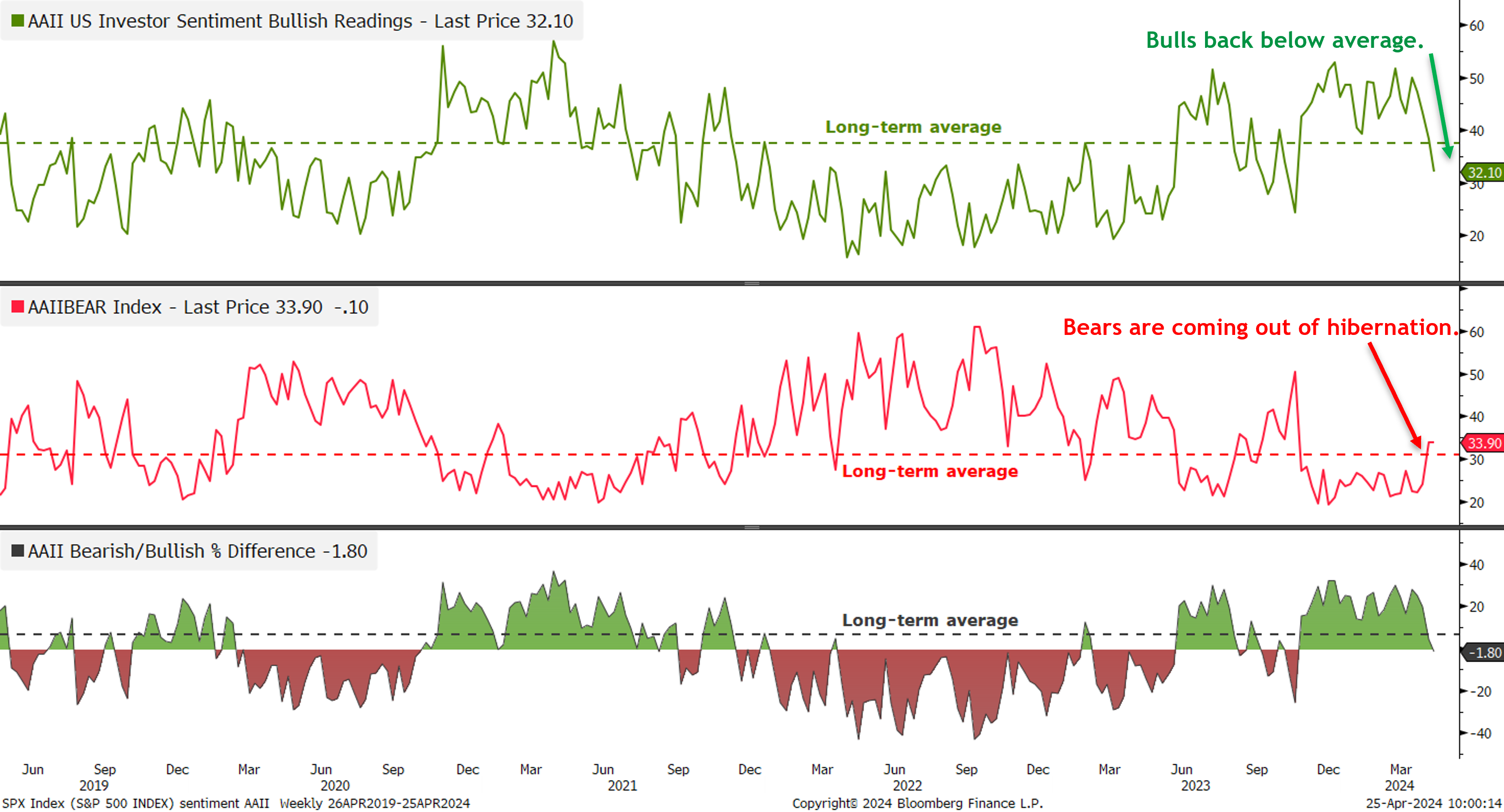

The chart below breaks down the weekly AAII bullish (top) and bearish (middle) percent readings, along with the spread between the data series shown in the bottom panel (Bull-Bear Index).

Sentiment Changes Directions

Source: LPL Research, American Association of Individual Investors, Bloomberg 04/25/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Bullish sentiment had been trending above average all year. Optimistic expectations for interest rate cuts, stronger than expected economic data and earnings, and excitement over artificial intelligence have all supported investor enthusiasm. However, sentiment began to sour as the market adjusted to a higher for longer monetary policy backdrop. Most would argue it was overdue as areas of froth were emerging amid overbought market conditions.

Last week, bearish sentiment jumped nearly 10% to 34%, snapping 23 weeks of below-average bearish sentiment. And while bearish sentiment was mostly unchanged this week, bullish sentiment dropped 6% to only 32% this week, down from over 50% last month and breaking below its long-term average for the first time in 25 weeks.

Combining bullish and bearish sentiment provides a more comprehensive perspective of risk appetite. As shown in the bottom panel, the bull-bear spread dipped into negative territory for the first time since early November.

What Does This Mean for Stocks?

The transition to bears outpacing bulls after a lengthy period hints at a potential change in the character of this bull market. Based on comparable periods when prolonged bullish sentiment ended, history points to positive but relatively subpar equity market returns over the next 12 months. The table below highlights the longest periods with a positive bull-bear spread and the performance of the S&P 500 during and after the streak ends. On average, the index was up 4.1% 12 months after the bull-bear spread turned negative, with 69% of occurrences producing positive returns. This compares to the average 12-month S&P 500 return of 9.3% for all periods across the same time frame.

AAII Bull-Bear Spread Turns Negative for the First Time Since November

|

|

|

Performance After Bull-Bear Spread Turns Negative | |||

End of Streak |

Consecutive Weeks in Positive Territory |

Performance During Period |

+1-month |

+3-months |

+6-months |

+12-months |

5/29/1998 |

56 |

32.4% |

4.4% |

-5.8% |

9.3% |

19.3% |

3/19/2004 |

50 |

27.6% |

2.3% |

2.3% |

1.7% |

7.2% |

4/19/1996 |

33 |

10.0% |

3.7% |

-1.0% |

10.2% |

18.8% |

3/24/2000 |

32 |

12.5% |

-6.4% |

-5.6% |

-5.2% |

-25.4% |

3/13/2015 |

31 |

7.8% |

1.9% |

2.0% |

-4.5% |

-1.5% |

5/28/1999 |

31 |

13.4% |

2.3% |

3.6% |

8.8% |

5.9% |

6/23/1995 |

28 |

21.9% |

0.7% |

5.8% |

11.3% |

21.3% |

3/11/2011 |

27 |

15.3% |

1.5% |

-2.6% |

-11.5% |

5.1% |

4/19/2024 |

24 |

14.0% |

- |

- |

- |

- |

7/16/2021 |

24 |

16.5% |

3.5% |

3.3% |

7.8% |

-10.7% |

1/24/2014 |

22 |

9.2% |

3.2% |

4.9% |

11.0% |

14.6% |

1/7/2005 |

20 |

6.9% |

1.3% |

0.4% |

1.0% |

8.4% |

11/17/2000 |

20 |

-9.3% |

-4.1% |

-4.8% |

-5.8% |

-16.7% |

4/24/1992 |

20 |

0.9% |

1.2% |

0.6% |

1.2% |

6.8% |

|

|

Average |

1.2% |

0.2% |

2.7% |

4.1% |

|

|

Median |

1.9% |

0.6% |

1.7% |

6.8% |

|

|

Percent Positive |

84.6% |

61.5% |

69.2% |

69.2% |

Source: LPL Research, American Association of Individual Investors, Bloomberg 04/25/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Summary

While sentiment is clearly not a science and is often best utilized as a contrarian indicator, the end of prolonged below-average bearish sentiment and above-average bullish sentiment implies investors may be losing some confidence in the strength of this bull market. Technical evidence further supports this observation, as dip buyers stopped showing up near the S&P 500’s 20-day moving average earlier this month, providing a timely signal for a deeper pullback. LPL Research does not believe the recent shift in sentiment marks the end of the bull market and from a technical perspective, continues to consider the 4,800 area on the S&P 500 as a worst-case scenario for a drawdown. Confidence for a relatively limited drawdown is supported by breadth metrics holding up well, cyclical sector leadership, limited signs of panic in credit or volatility gauges, economic resiliency, and the longer-term momentum implications of this rally.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #571088

Adam Turnquist

Adam Turnquist oversees the management and development of technical research at LPL Financial. His investment career spans over 15 years.