Posted by lplresearch

Top Story

Fed Day. The Federal Reserve (Fed) finishes their two-day Federal OpenMarket Committee (FOMC) meeting today with a decision on interest rates and policy statement, followed by a press conference with Chair Jerome Powell.

- It is widely expected rates will stay at 0%, but the Fed will likely increase their view of the U.S. economy.

- An updated Dot Plot will show when members expect the first rate hike. As of December, 0.0%-0.25% through 2023 was expected, but with higher rates and potential inflation, this could move up.

- What Powell has to say about higher interest rates and inflation will be closely watched. Remember, two weeks ago rates saw a big surge in yields after Powell said he was comfortable with current policy.

- Will the Fed increase their bond buying to put a lid on yields, similar to what the European Central Bank did last week? Or will they announce potential tapering? Either way, this will come up and will be important.

- For more of our views on today’s meeting, please read Five Questions for Chairperson Powell.

Daily Insights

The one-year anniversary of the bear low is coming. Hard to believe it, but next week will be one year since the S&P 500 Index bottomed after the record 34% bear market.

- We found there have been six other bull markets since WWII.

- The average bull market after one year is up 43%, with this bull up close approximately 75%, making it the best start to a bull market ever, topping the 2009 start.

- The good news is all six previous bull markets gained in year two, suggesting this bull market could have a few more tricks up its sleeve.

- For more on this, see today’s LPL Research blog, available at 12pm ET.

US stocks snap five day winning streak ahead of Federal Reserve (Fed) meeting; 10-year Treasury

trades above 1.66%.

- Nasdaq leading US indices lower in early morning trading.

- European markets modestly lower in midday trading with United Kingdom underperforming.

- Asian stocks mixed overnight after many indices fell from their intraday highs.

The win streak is over. Stocks finally fell yesterday, breaking some long win streaks.

- The S&P 500 Index fell after gaining 5 days in a row, the longest since6 in a row in early February.

- The Dow ended a 7-day win streak, longest since last August.

- Impressively, the Dow ended a historic streak, as it made a new high and was up > 0.5% four days in a row for only the third time since WWII.

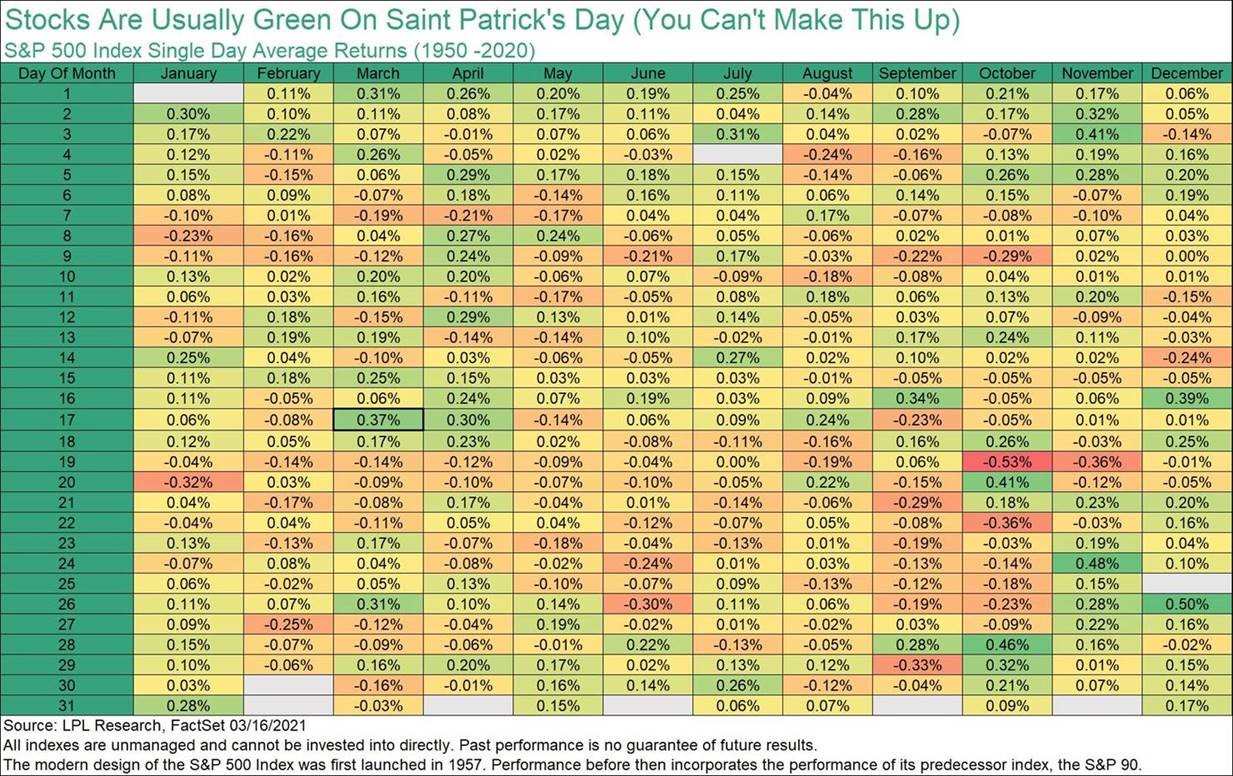

Green for Saint Patrick’s Day? Although we would never suggest investing based on just one day, it is fun to point out that Saint Patrick’s Day is historically one of the ‘most green’ days of the year for stocks! Below shows the average one day return for all days of the year (1950 – 2020) and wouldn’t you know it, Saint Patrick’s Day is one of the best!

Here’s a nice table you can save that shows how all the days of the year do historically.

Technical Update

Major indexes moved lower yesterday, with the exception of the Nasdaq which managed a slight gain. Selling was more pronounced in recent winners, as small caps, financials, industrials and energy all lost more than 1%. Of note this morning, the 10-year Treasury yield has hit a new recovery high at1.66%

COVID-19 news

The US reported 52,000 new COVID-19 cases on Tuesday, down 9.3% week over week, although daily results are becoming more mixed (source: Johns Hopkins).

- Health officials in Michigan have cited concerns over the B117 variant as cases in the state have been climbing in recent days despite 21% of the population receiving at least one shot of the vaccine.

- Cases in Europe continue to climb in many countries, with Germany, Austria, and the Netherlands reporting fairly rapid increases

- Rising cases in Europe also occurring amid intense scrutiny and even an outright halt of the distribution of the AstraZeneca vaccine in the region.

March Madness: Stock Market Edition

LPL Research share their “Final Four Factors” for the stock market in 2021. Learn more in this week’s Weekly Market Commentary.

4 Things That Really Matter For Stocks in 2021

This week on the LPL Market Signals podcast, Chief Market Strategist Ryan Detrick and Equity Strategist Jeff Buchbinder discuss four things that matter the most for stocks in 2021.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data are from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL),a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05123046