posted by LPLresearch

Lately, we’ve seen two things swirling that some investors think could hurt them down the road. The idea that higher yields and rate hikes are bad is all over the place, but it all might not be so simple. In fact, looking back at history, neither are necessarily true.

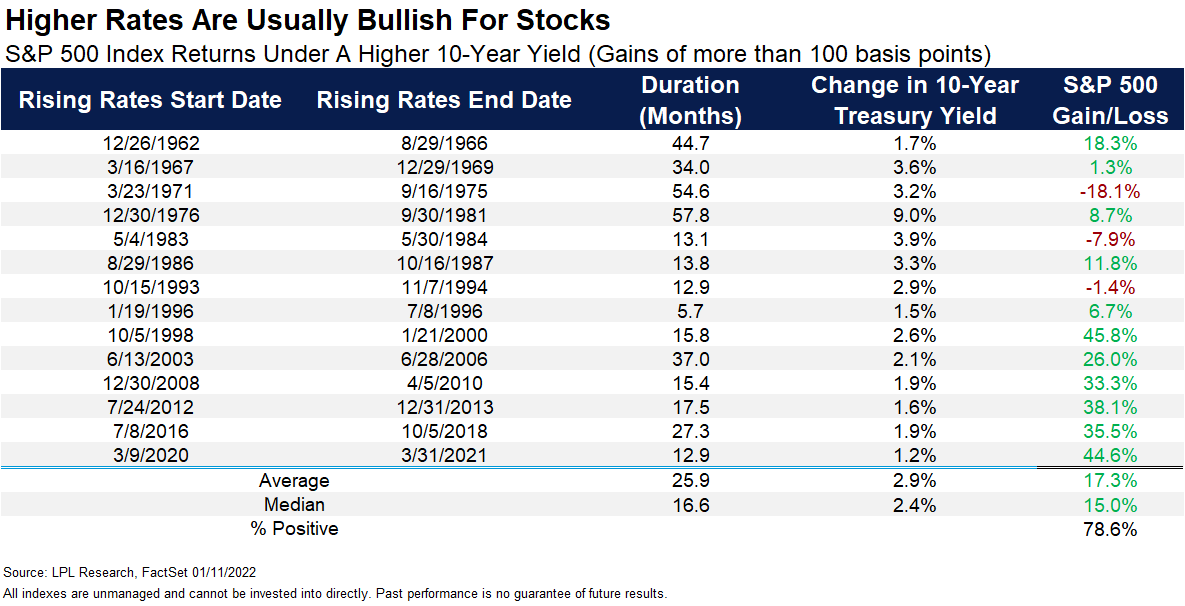

First up, the 10-year Treasury yield has soared to start this year, with many high flying tech stocks falling as a result. But is this bad for all stocks? “Higher yields usually mean the economy is growing, not slowing,” explained LPL ChiefMarket Strategist Ryan Detrick. “For this reason, when yields go higher, stocks tend to do quite well, quite opposite from what you’ll hear happens when watching tv.”

As shown in the LPL Chart of the Day, the past six times we saw an extended period of a higher 10-year Treasury yield, stocks also rose. In fact, some of those periods saw gains well over 30%. Should the 10-year continue to move higher, this could actually support a higher trending bull market, much different than what most think.

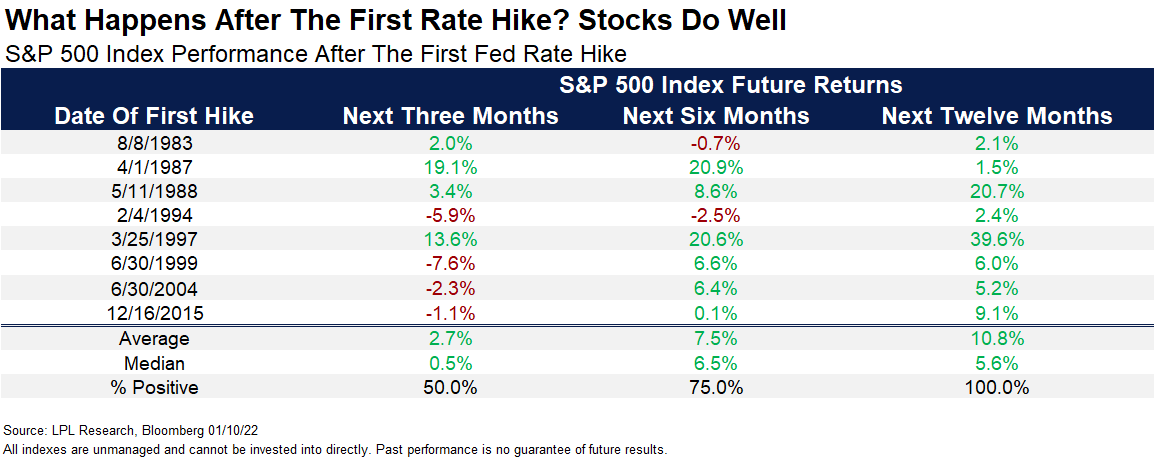

Next up, many are worried about the Federal Reserve Bank (Fed) hiking interest rates for the first time (to start a new cycle of hikes) since December 2015. Yes, history would say stocks could see more volatility after rate hikes, but this could be a function of the economy aging by the time hikes happen. An aging economy and bull market tends to see more big moves.

But Fed rate hikes by themselves don’t mean the bull market is approaching an end. In fact, a year after the first hike in the previous 8 cycles saw the S&P500 Index higher a year later every single time. Yes, some of those returns were muted, but by no means was this a bearish event for investors.

There are many things to worry about, but in the end, if the economy is still humming along (it is) and earnings are still strong (they are), then continued higher equity prices are likely.

For more of what could upset the apple cart this year, be sure to watch the latest LPL Street View with Ryan Detrick, as Ryan breaks down 3 Things to Look Out For In 2022.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05231836

“Busting Two Myths: Why Higher Yields and Rate Hikes Aren't Always Bad.” LPL Financial Research, 12 Jan. 2022, https://lplresearch.com/2022/01/13/busting-two-myths-why-higher-yields-and-rate-hikes-arent-always-bad/.