Posted by lplresearch

“One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world.” –Jesse Livermore

Countless stock investors would prefer to exit their investment precisely at the top and put their money back into the market at the very bottom of a market correction. Avoiding volatility may sound good in theory, but volatility is the price of admission for the stock market, and the challenge of calling tops and bottoms can be an expensive one indeed.

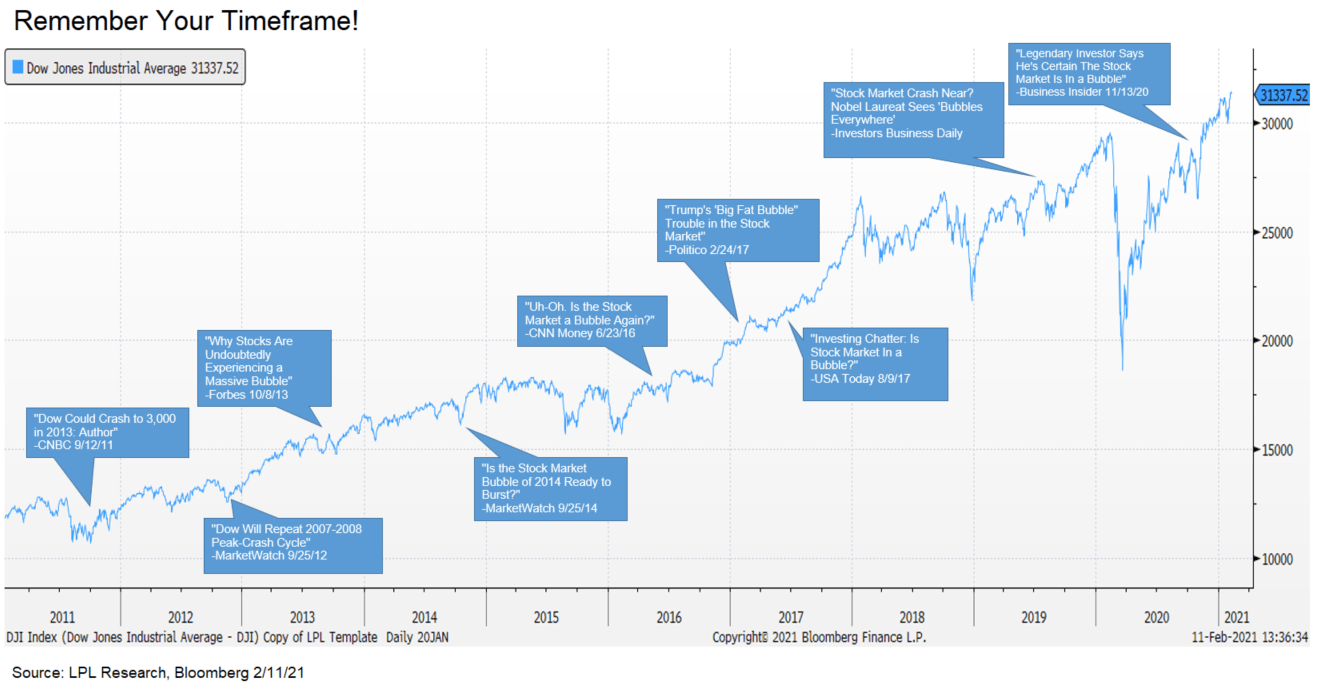

Television, social media, and now websites like Reddit can create noise that can be distracting for investors, which can cause them to lose focus of their timeframe—which for many of us is a long time. Often times this can cause investors to make rash decisions and pull their money from the market even though the market continues to advance.

As shown in the LPL Chart of the Day, there have been a plethora of media headlines over the last 10 years that could have caused someone to get fearful of the near term:

“It’s the media’s job to get you to tune in, but it’s our job as investors to focus on our long-term goals,” noted LPL Financial Chief Market Strategist Ryan Detrick. “Drawdowns and bear markets are part of the path to get there, and limiting the latest shiny object from affecting our decisions is key to any investment strategy.

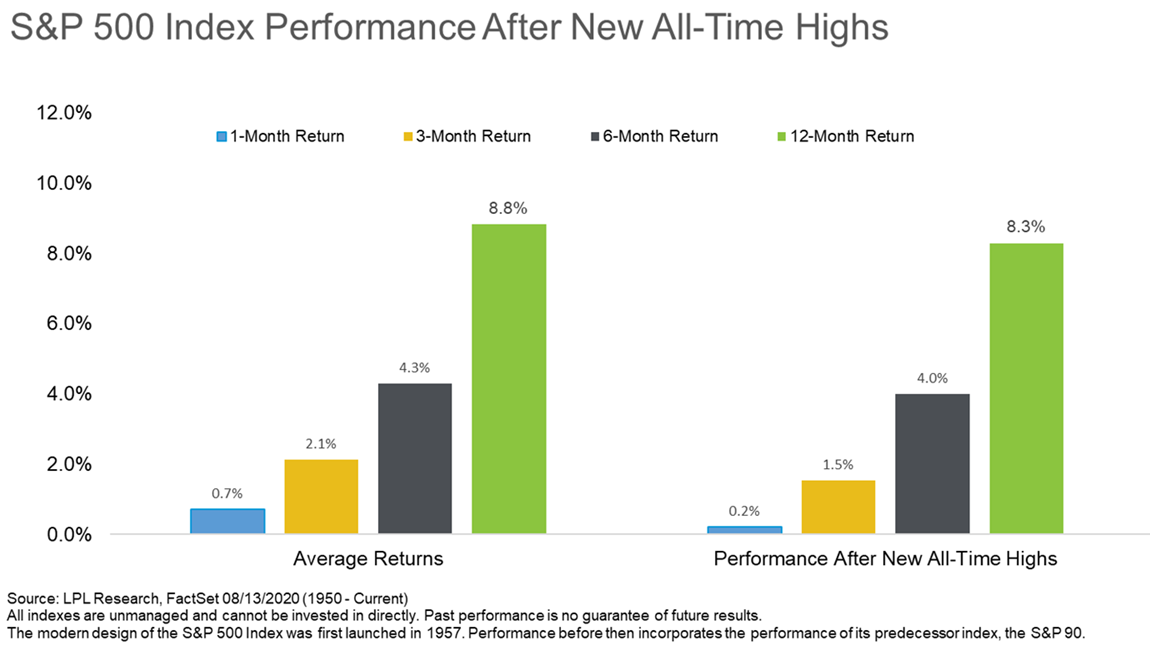

Despite recording the fastest bear market in history in March 2020, and as difficult of a time as we’ve seen in recent years, looking past the short term when investing in stocks has proven to be the correct decision. With markets trading near all-time highs today, many are concerned that this could be another top. However, history has proven that the returns from all-time highs still tend to be solid over the next 6-12 months:

So where do we go from here? Well, there is no guarantee of future returns, but history has proven that the stock market has generally rewarded investors for riding out any near-term volatility—as long as they’re willing to wait it out. We continue to believe that stocks remain more attractive than bonds as the global economy emerges from the turmoil caused by the global pandemic, while potentially rising interest rates could limit the upside potential for bonds.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1- 05111123