The election is expected to increase short-term market volatility, with historical correlations suggesting potential stock market fluctuations tied to political uncertainty. While differing candidate policies could create specific investment opportunities across areas such as trade, energy and fiscal policy, we believe that bond markets and alternative investments may offer diversification and stability amid policy uncertainty. More strategically, stocks have performed well under presidents from

View More

Blog

Stock Markets: What To Expect When We’re Electing

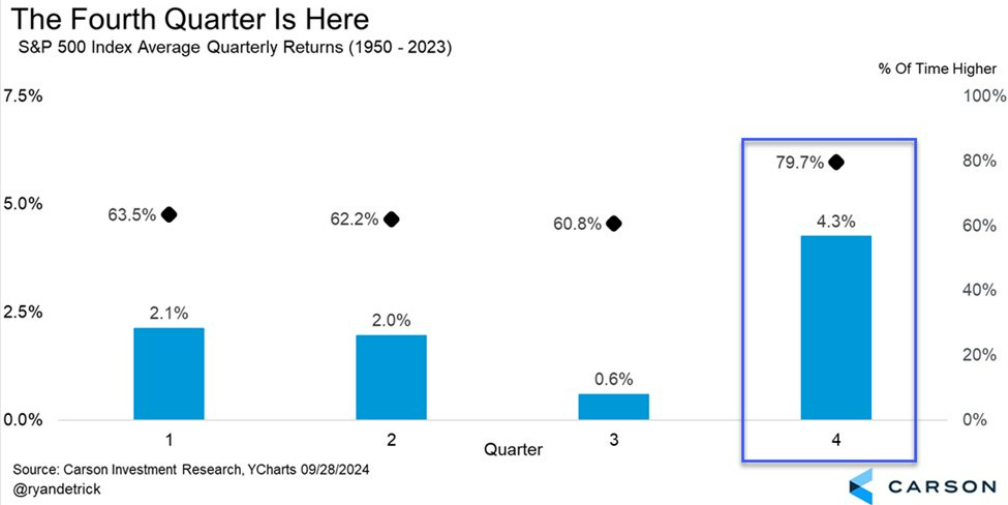

October 15, 2024The Fourth Quarter is Here

October 9, 2024

The fourth quarter is almost here. Historically, this is the best quarter for stocks.

View More

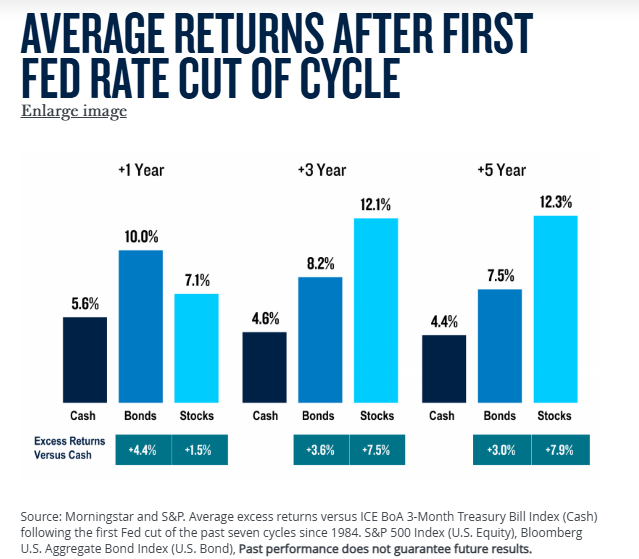

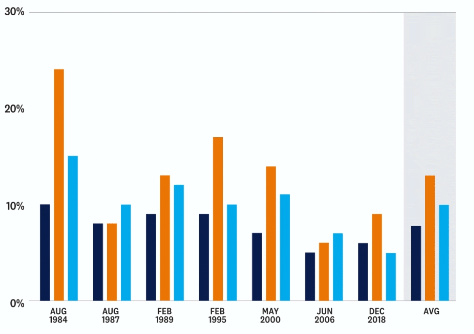

Average Returns After First Fed Rate Cut of Cycle

October 9, 2024

The Federal Reserve signaled its intention to cut short-term interest rates, an event associated with previous rallies in stocks and bonds. Following the start of the past seven rate-cutting cycles, bonds showed the most immediate benefits while stocks exceled over the long term.

View More

Tax-Savvy Withdrawals In Retirement

September 13, 2024

It's official: You're retired. Consider a simple strategy to help reduce taxes on retirement income.

View More

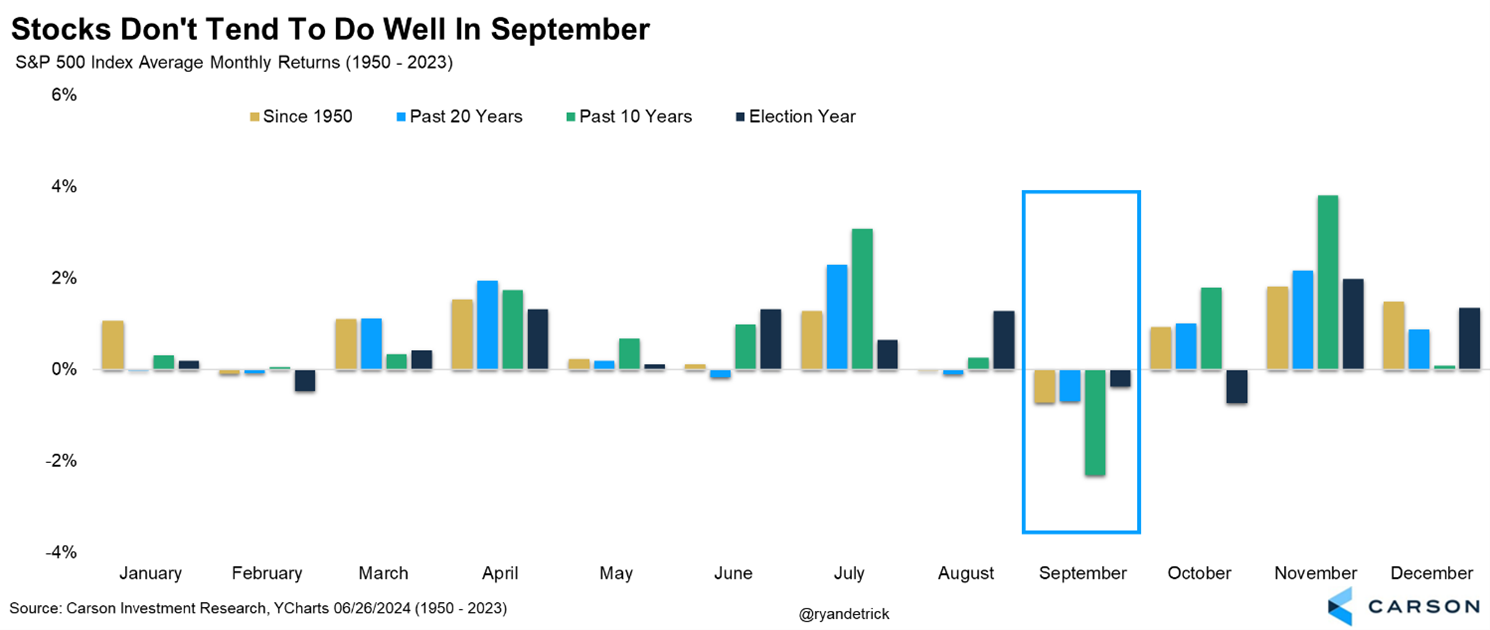

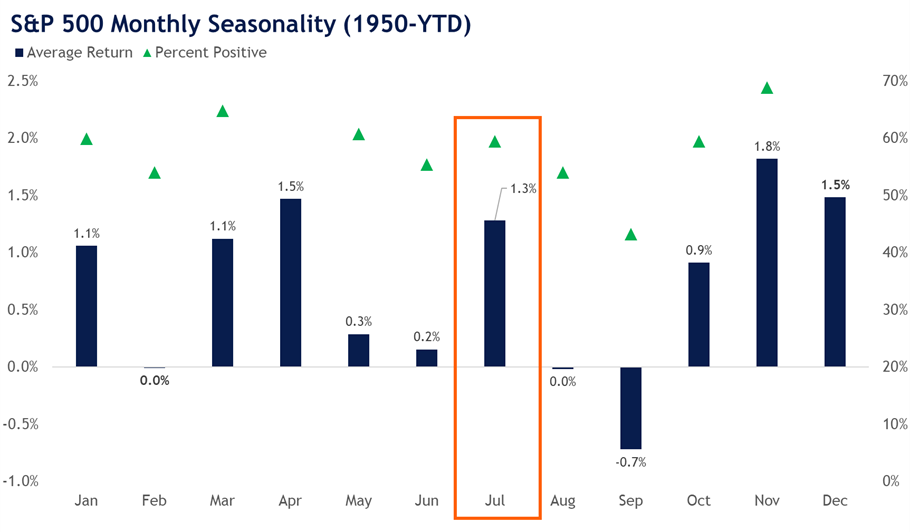

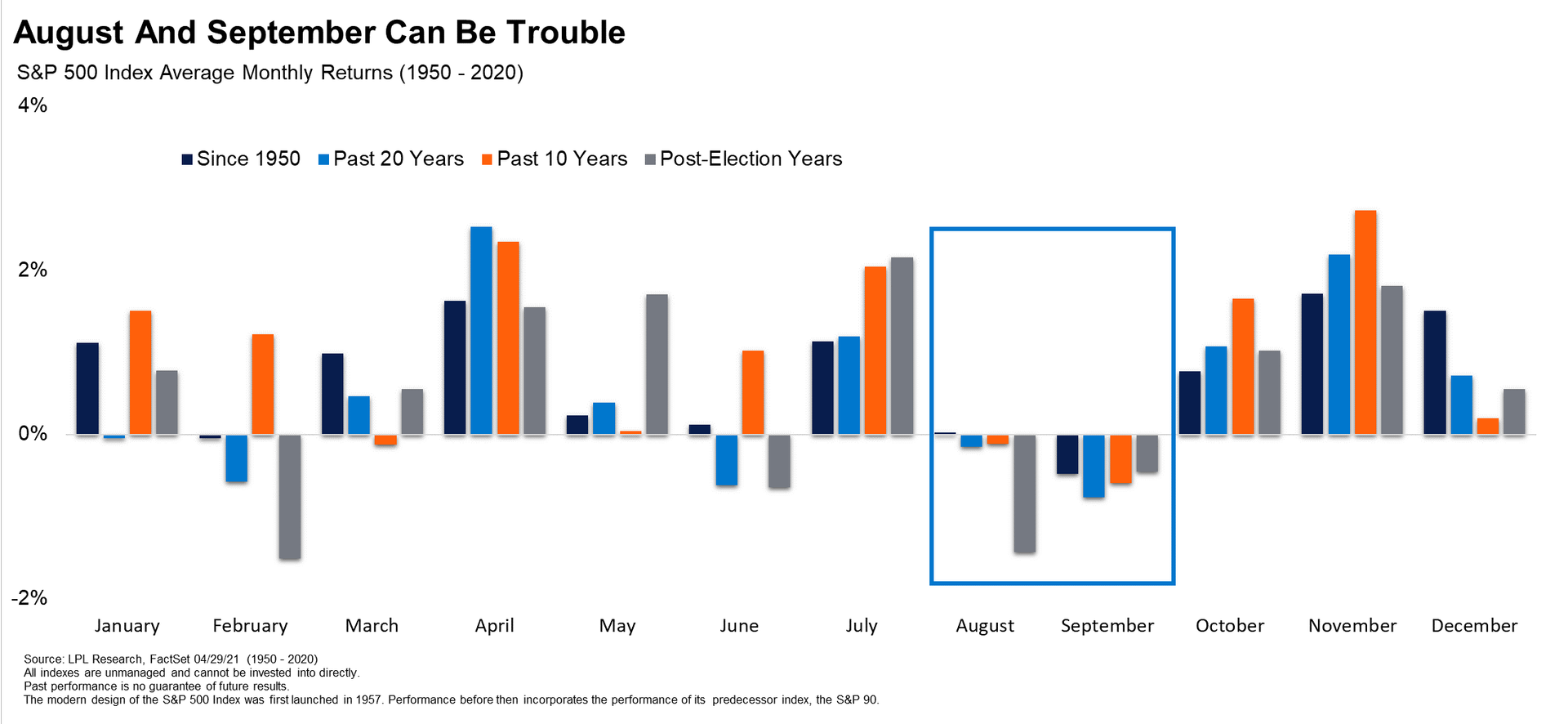

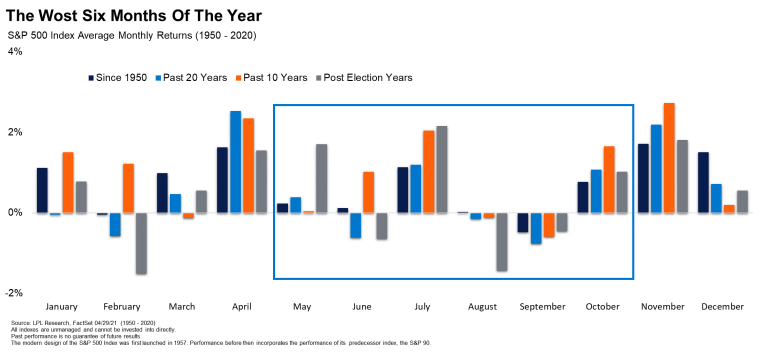

Stocks Don't Tend To Do Well In September

September 11, 2024

Here’s a better look at election years and monthly returns. August bucked early month weakness this year and turned in a solid gain, but the next two months are notorious for weakness in election years. The good news? Year-end rallies are quite normal after the election is out of the way.

View More

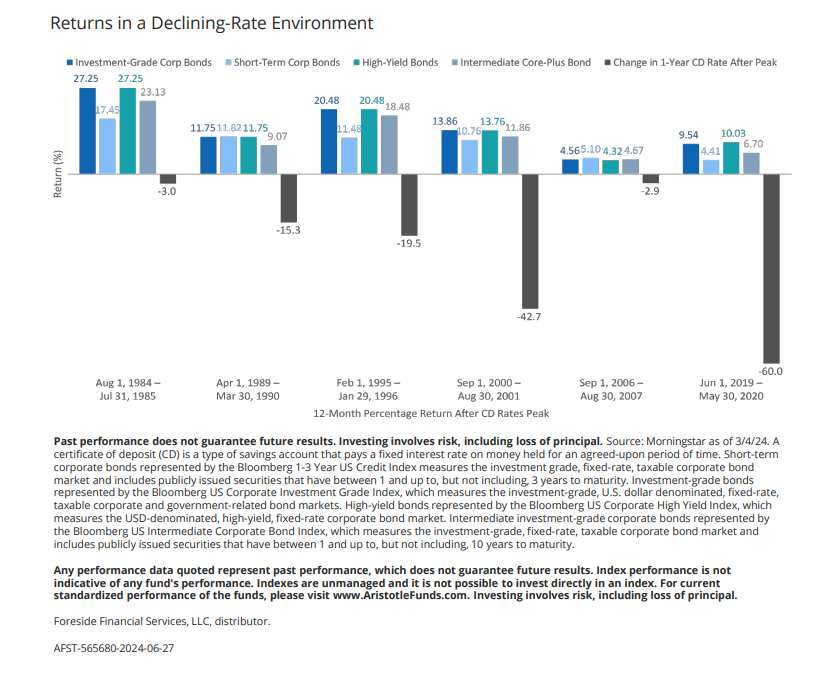

Returns in a Declining-Rate Environment

September 5, 2024

While certificate of deposit (CD) rates have dramatically risen since early 2022, history has shown they decline just as rapidly. In the six times since 1984 when CD rates peaked, returns have declined in the following year by an average of 28%. During these periods, many corporate fixed-income sectors have outperformed CDs by a wide margin.

View More

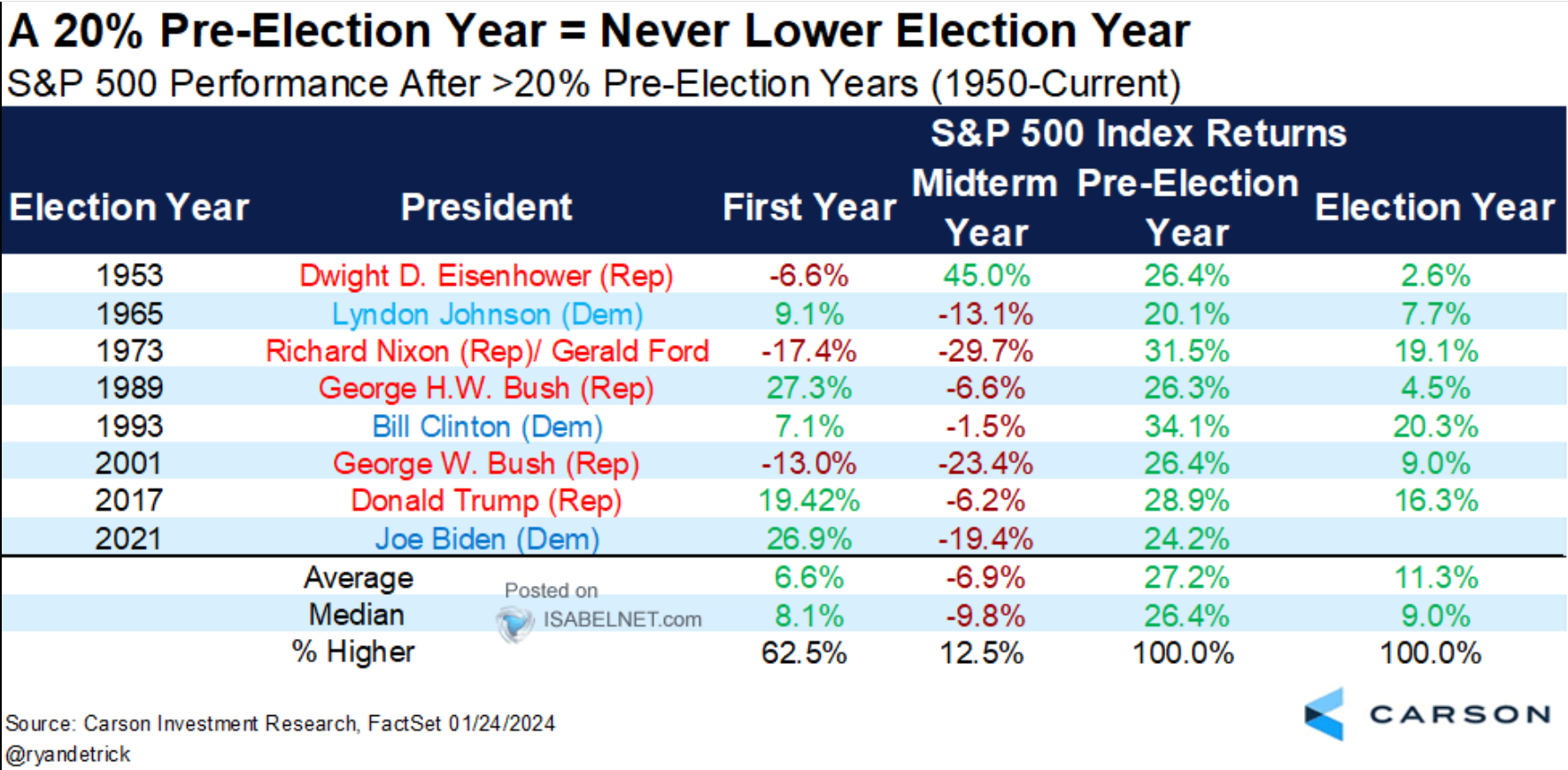

20% Pre-Election Year- Never Lower Election Year

September 5, 2024

Following a pre-election year gain exceeding 20%, the S&P 500 index has consistently shown positive growth during the election year, with an average increase in value of 11.3% since 1950.

View More

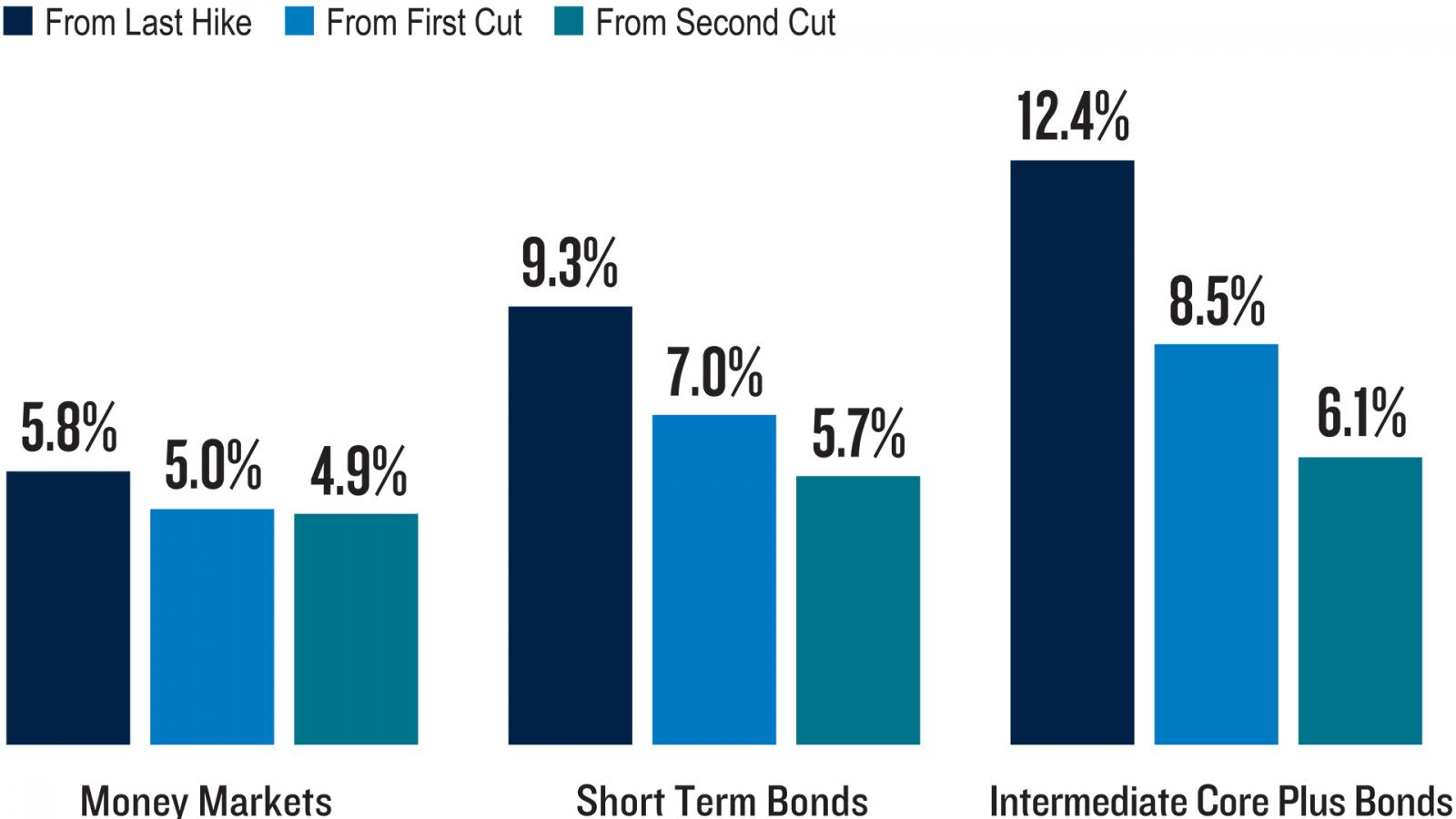

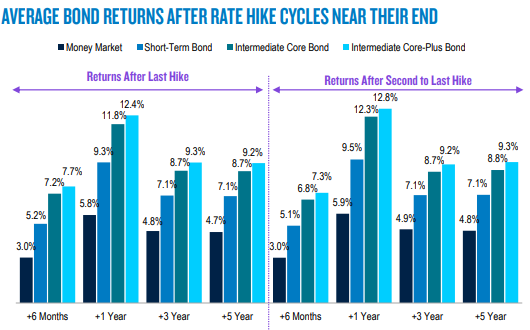

Extending Duration Near Fed Policy Changes Tends To Pay Off

August 22, 2024

The Federal Reserve (the Fed) has signaled short-term interest rates cuts soon. Over the past four Fed rate cycles, higher-duration bonds outperformed shorter-duration bonds and money markets near Fed policy changes, with the strongest returns before the first cut.

View More

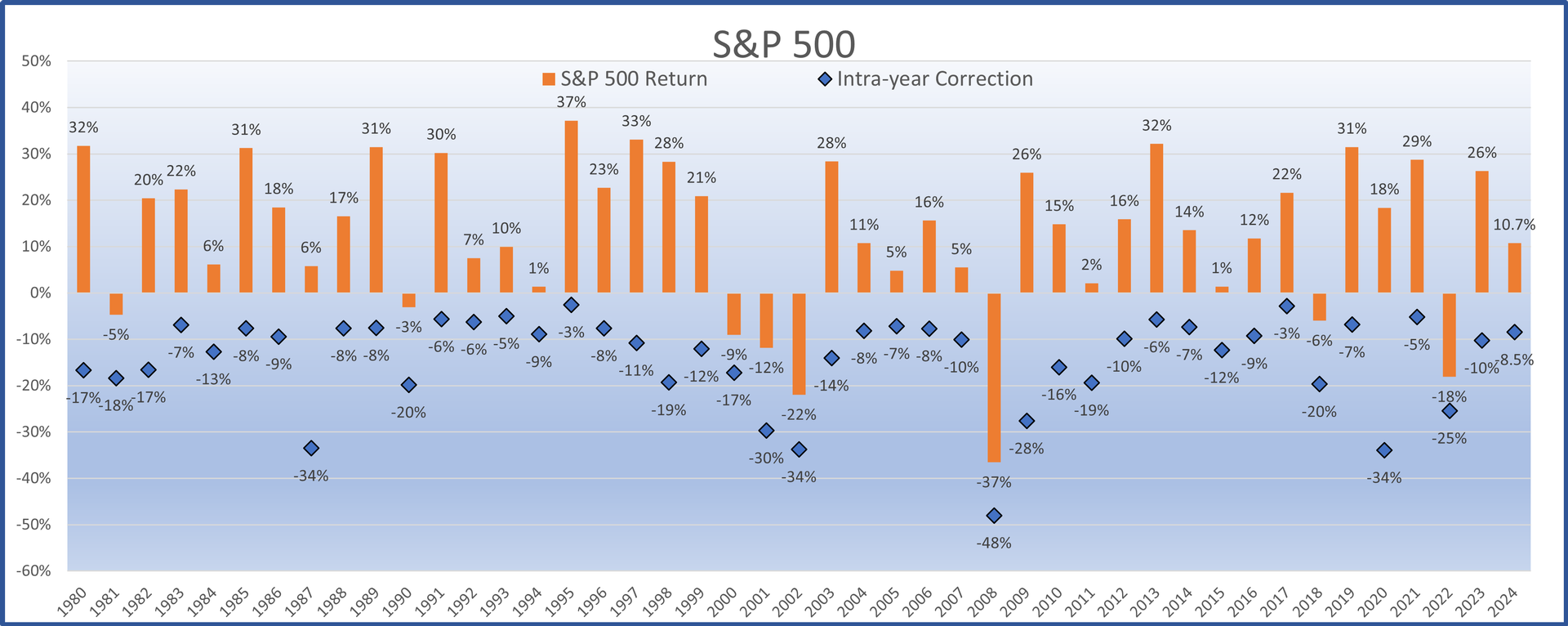

More Pullback Perspective

August 8, 2024

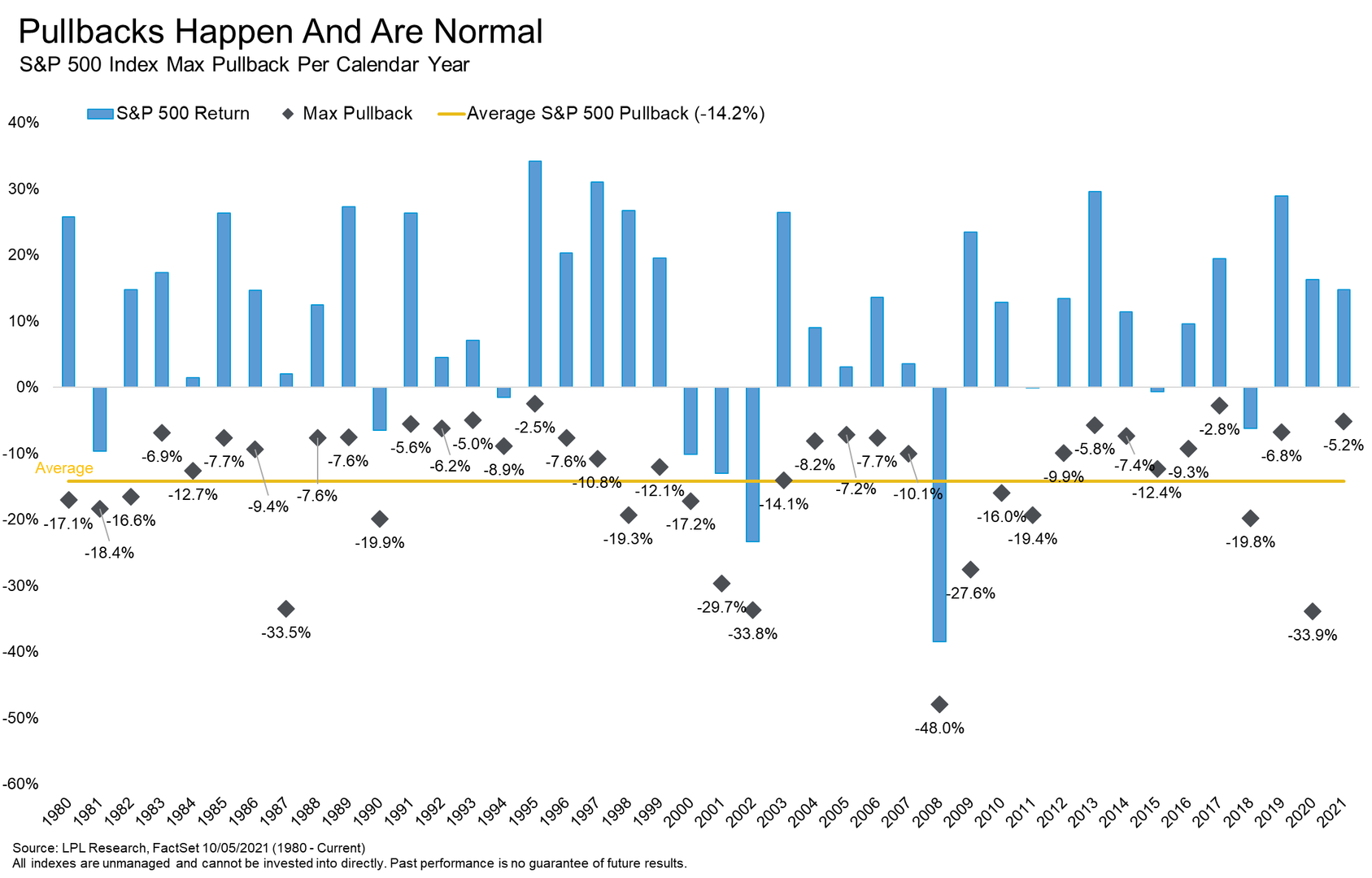

This latest bout of market volatility has been unsettling, especially after such a calm 2023 and 2024 for stocks. However, with the benefit of some historical perspective, volatility of this magnitude is quite common.

View More

Election Anxiety? Could Bonds Calm Your Fears?

July 22, 2024

With election season in full swing, investors may be concerned about how either a second Joe Biden or a second Donald Trump presidential term would impact their portfolios. However, as we said in Midyear Outlook 2024: Still Waiting for the Turn, for the long-term investor, political opinions are best expressed at the polls and not in portfolios.

View More

LPL Research: 2024 Midyear Outlook

July 12, 2024

As we reach the halfway point of 2024, a sense of persistence defines the economic and market landscape. Trends from late 2023 have continued, with surprisingly resilient economic growth mixed with stubborn but decelerating inflation. Equity markets have thrived and regained all the lost ground from 2022. On the other hand, the bond market still grapples with policy uncertainty and remains range bound for the most part.

View More

Seasonality Heats Up in July

July 5, 2024

Today's LPL Financial Chart of the Day highlights the seasonal setup for the S&P 500.

View More

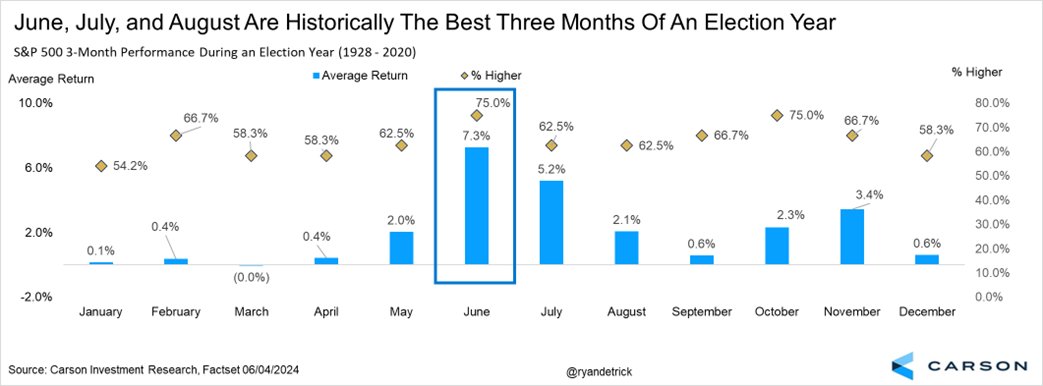

June, July and August are Historically the Best Three Months of an Election Year

June 28, 2024

Jenny Han (The Summer I Turned Pretty author) said “Everything good, everything magical happens between the months of June and August.”

View More

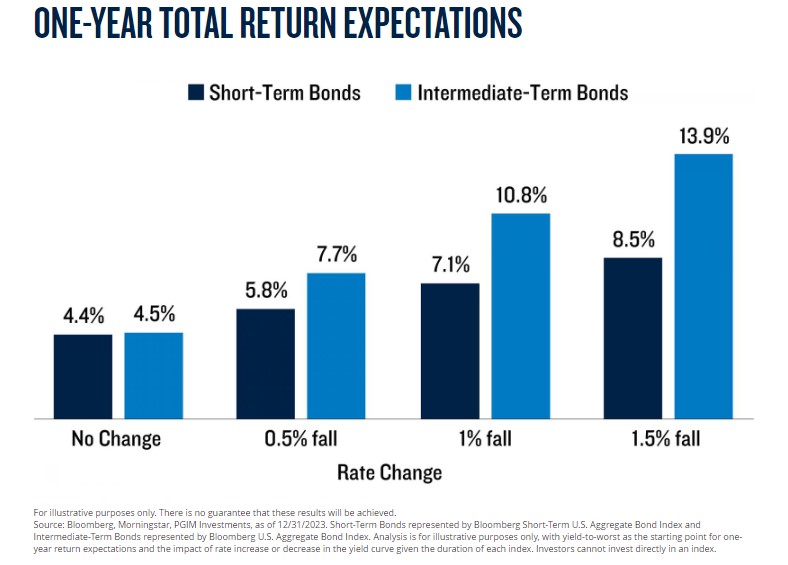

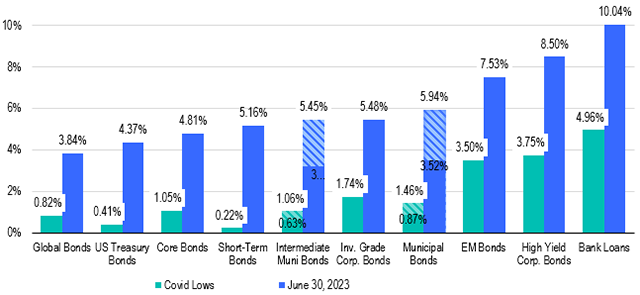

One-Year Total Return Expectations

June 14, 2024

Bonds increasingly attractive if Fed cuts rates.

View More

Stocks Up 4% in May is a Very Good Thing

June 14, 2024

Since 1950, the S&P 500 has never been lower a year after a monthly gain of over 4% in May. This period has been particularly profitable for investors, with an average gain of 20.1%.

View More

Key Market Themes During Election Periods

May 24, 2024

We recognize the presidential election is still a way off, but it’s not too early to draw some policy contrasts between the candidates. Though a sitting and former President facing off limits the amount of potential policy uncertainty investors must consider, there is no doubt the two candidates offer two distinct policy approaches in several key areas.

View More

The Most Favorable Real Estate Sectors for the Next Five Years

May 20, 2024

As the commercial real estate recovery takes shape, not all real estate sectors are likely to rebound the same. This month’s chart, courtesy of CBRE, presents their income and total return forecast for various sectors with Bluerock high conviction sectors on the left.

View More

Bears Come Out of Hibernation

April 29, 2024

Like clockwork, the arrival of spring has awoken the bears from a deep winter slumber. The silencing 10% first-quarter S&P 500 rally was interrupted by alarm over escalating geopolitical conflicts in the Middle East, reduced rate cut expectations, and surging interest rates as confidence in the Federal Reserve's (Fed) battle against inflation was shaken. Equity markets reacted by pulling back from overbought levels, while Treasury yields rerated significantly higher.

View More

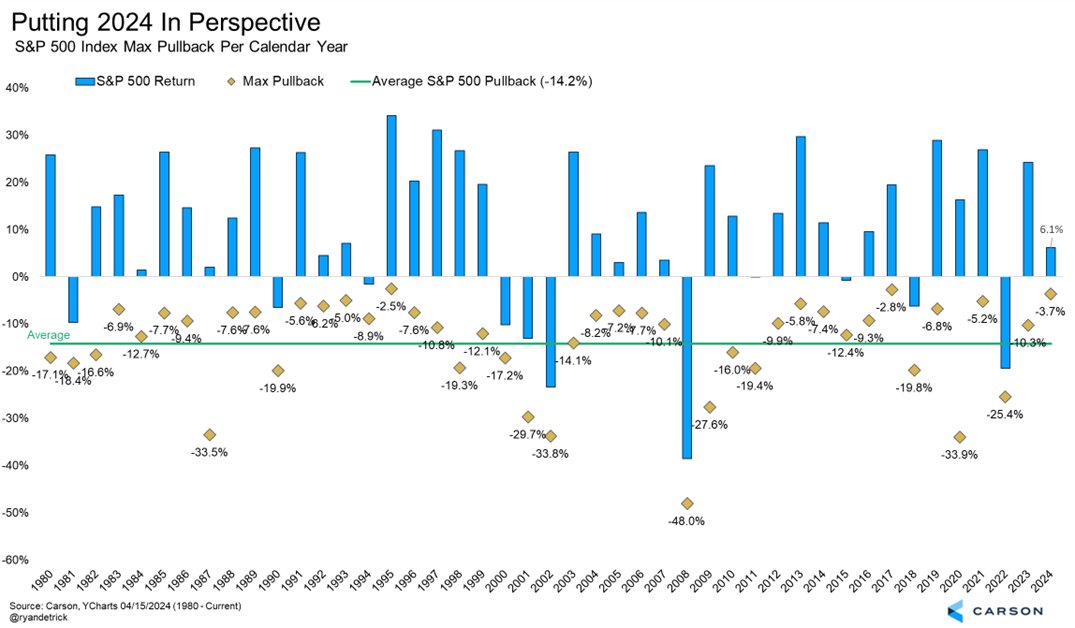

Putting 2024 In Perspective

April 29, 2024

23 of the past 44 years saw the S&P 500 correct 10% or more at some point during the year.

View More

529 to Roth IRA New Provisions

April 25, 2024

What if you don't need all that money for school after all? If your child received a scholarship, you can still access the money up to the amount of the scholarship free of penalty. But you will have to pay taxes on the earnings. Or perhaps your child is attending a more affordable school, or room and board expenses are less than expected.

View More

Bonds Increasingly Attractive if Fed Cuts Rates

April 1, 2024

The Federal Reserve recently signaled potential rate cuts in 2024 after raising rates 525 basis points between March 2022 and July 2023.

View More

Who Do Markets Want to Win the Election?

March 12, 2024

Election season is in full swing as Super Tuesday solidifies another Biden and Trump rematch this November. President Biden won all 15 states and the Iowa caucuses, while former President Trump won in 14 of 15 states, prompting Nikki Haley to end her election bid.

View More

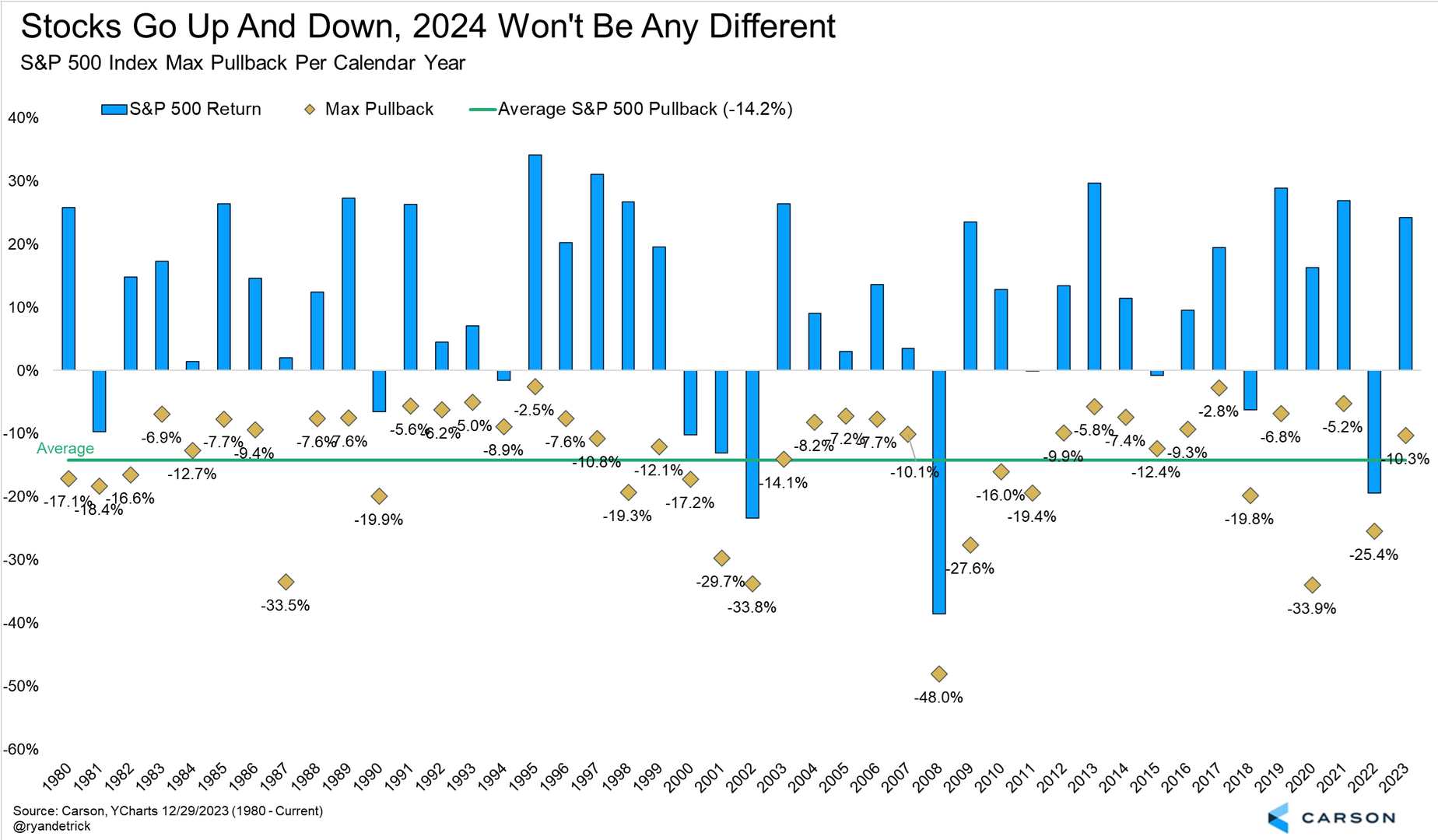

Stocks Go Up and Down, 2024 Won't Be Any Different

March 12, 2024

If it feels like we haven't had a 2% mild pullback in forever, that's pretty much because we haven't.

View More

2024 Election: People Care About Elections. Markets Don't.

February 5, 2024_Page_15.jpg)

"It may feel like we are living in uncertain times."

View More

The Long View: Here Comes the Sun?

January 17, 2024

Differing dynamics have made historical recession guideposts somewhat less reliable lately, yet many parts of the economy are showing signs of increased strain, suggesting the economic cycle may have been elongated rather than eliminated.

View More

What Typically Happens to the Stock Market in Election Years?

January 9, 2024YouTube video from Capital Group

View More

You’re Age 35, 50, or 60: How Much Should You Have Saved for Retirement by Now?

December 28, 2023

It’s important to make steady progress toward saving for retirement, no matter what your age.

View More

What a Difference a Year Makes

December 22, 2023

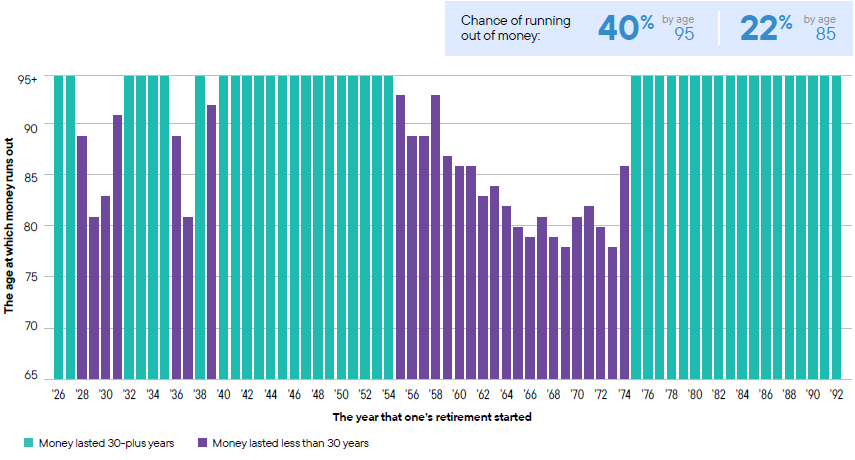

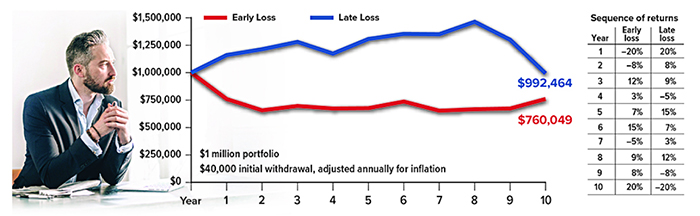

The year in which an investor retires can have a huge impact on how long their money will last in retirement. In addition to market performance, there are other important factors to consider when planning for a retirement that could last 30 years or more.

View More

Election 2024: How Stocks Perform in Election Years

December 20, 2023

The 2024 presidential election may be one of the biggest market-moving catalysts in the next 12 months. It's too early to speculate about a potential winner, but current polling indicates a likely rematch between Democrat Joe Biden and Republican Donald Trump. However, there may be room for an outsider to disrupt the rematch at some point, given both Trump and Biden have low favorability ratings among voters.

View More

Presidential election years like 2024 are usually winners for U.S. stocks

December 18, 2023

As the 2024 U.S. presidential election approaches, many investors are worried about the impact that politics might have on their portfolios. While this concern is likely driven by the avalanche of headlines generated around both the 2024 and 2020 elections, a review of past election cycles going back to 1937 suggests that the upcoming election shouldn't be a cause for concern.

View More

Outlook 2024: A Turning Point

December 14, 2023

Recently, the LPL Research team published the 2024 Outlook: A Turning Point. A check-in on where the markets have been and where they seem to be headed, this report is a great guide to help steer personal portfolios. If you haven’t read it yet in its entirety, take a minute to tap into some of the key takeaways.

View More

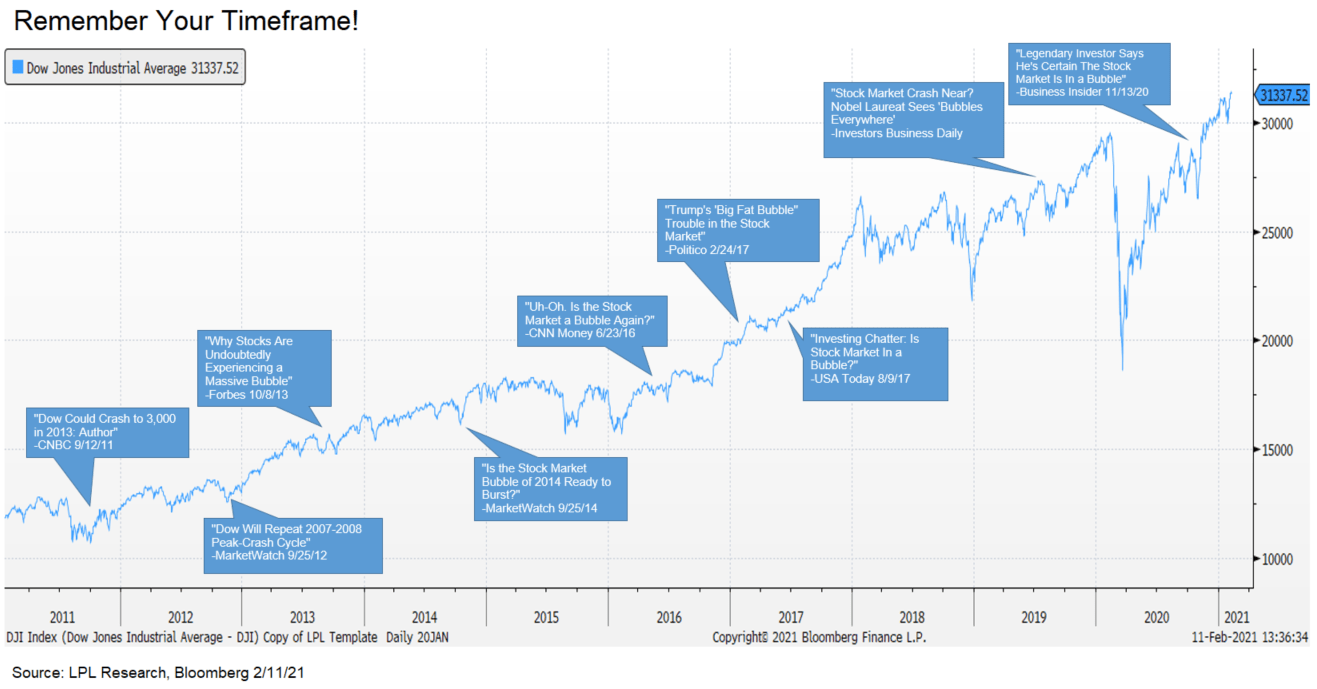

Keeping Time on Your Side

December 13, 2023

While it may be hard to stay patient when your portfolio lags, it's important to remember that one of the most powerful drivers of long-term returns is time invested. Staying invested keeps time on your side.

View More

Consumers Getting a Mixed Bag

December 4, 2023

Consumers are contending with a confounding housing market. As prices for durable goods fall, consumers retained an appetite for purchasing major items, but the pace of spending will likely slow in the coming months.

View More

Seven Year-End Planning Ideas for Retirement Savings

November 24, 2023

Year-end is an opportune time to review existing retirement and income plans to determine if changes are needed.

View More

LPL By the Numbers

October 30, 2023

Who we are - LPL Financial

View More

Assessing Potential Market Impact of Israel-Hamas War

October 12, 2023

On Saturday, Hamas, a Palestinian militant group designated as a terrorist organization by the U.S. government, launched an attack on Israel, killing hundreds of civilians and taking dozens more hostage. In response to the attack, Israel launched a counteroffensive on Hamas positions in the Gaza Strip (one of two Palestinian territories, the other being the West Bank), a territory home to 2.3 million Palestinians under Hamas rule.

View More

October Stock Market Seasonals: Trick or Treat?

October 5, 2023

As another scary September for stock markets draws to a close with what will almost certainly be a second consecutive monthly loss for the S&P 500 Index, we take another look at what clues seasonality data may give us for stock market performance during October and the remainder of 2023. So far September has lived up to its reputation, especially in recent years, as being one of the worst months for stocks. In fact, the S&P 500 is on track for its worst monthly return since December 2022.

View More

Guide to Recessions

September 29, 2023

When is the next U.S. recession and how should you prepare for it?

View More

Seven Things to Know about Government Shutdowns

September 28, 2023

The government is likely to shut down on October 1. What does this mean for the market?

View More

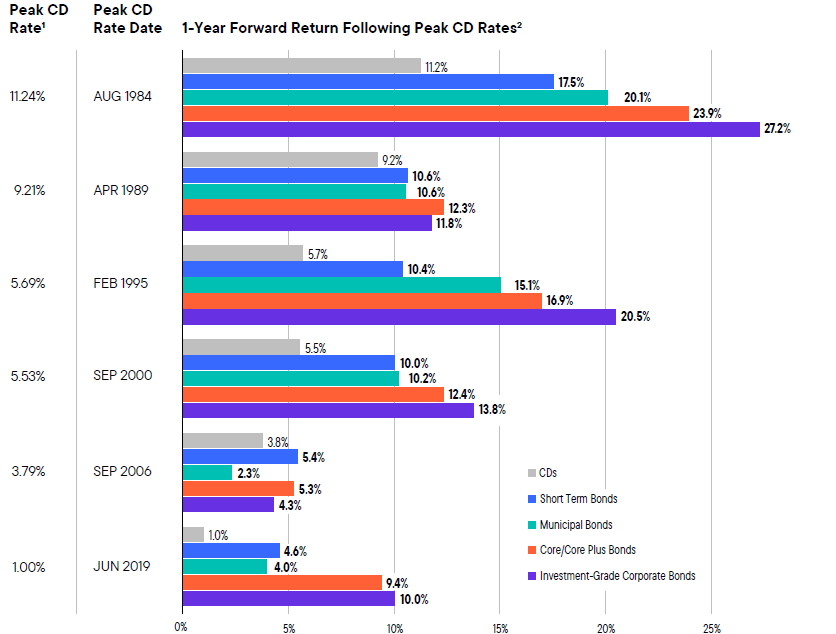

Peak CD Rates Don't Always Result in Peak Performance

September 26, 2023

In 2022, the Federal Reserve began aggressively raising interest rates and has continued to do so in 2023, albeit at a much more measured pace. This has helped many certificate of deposits (CDs) increase their interest rates to levels not seen in well over a decade. However, while investing in CDs at peak rates might seem like a sound strategy, in the past it hasn’t always translated into the best outcome for investors.

View More

Higher Duration Assets Tend to Outperform After Tail End of Rate Hike Cycles

August 25, 2023

The Federal Reserve has signaled its current interest rate hiking cycle may end soon.

View More

Is a Good CD Rate Too Good to Be True?

August 25, 2023

It's easy to see why CDs are such a tempting investment today. With their relative safety and the most attractive rates in years, some above 4 or 5%, it seems like there's not much to lose. However, you could end up missing out on even greater returns.

View More

Fixed Income Sector Yields

August 18, 2023

Many fixed income sectors now offer yield opportunities that haven’t been seen in over a decade.

View More

Core Bonds Tend To Do Well During Fed Pauses

August 16, 2023

During the Fed rate-hike pauses, core bonds tend to perform well as proxied by the Bloomberg Aggregate Bond Index.

View More

The Taylor Swift Era, Consumer Spending & Inflation Clarity

July 24, 2023

As the dog days of summer roll on, American consumer spending patterns are coming into focus. One experience in particular has captured the most attention and has managed to exemplify today’s consumer—Taylor Swift’s ‘The Eras Tour.’

View More

Correlation Comparisons

July 18, 2023

The second half of 2023 is off to a relatively slow start. Correlation analysis comparing the first half of prior years to 2023 suggests history is on the market's side.

View More

Pause and Reflect

June 29, 2023

As expected, the Federal Reserve (Fed) paused its rate-hiking cycle last week after 15 consecutive months of tightening. Over the last 35 years, there have been five other monetary policy periods when the Fed paused after a major rate-hiking cycle. During these periods, it took anywhere from four to 15 months before the Fed started cutting rates, with the average pause lasting 6.8 months.

View More

Five Week Positive Streak for the S&P 500 Ends -Now What?

June 29, 2023

We decided to take a look at what has historically happened next when an S&P 500 weekly streak of this length has come to an end, as well as looking at streaks for the NASDAQ 100 index.

View More

How Long Might This Bear Market Recovery Take?

June 15, 2023

Now that the S&P 500 Index has entered a new bull market (by gaining 20% or more since the October 2022 lows), it’s logical to ask the question of when the index might achieve a new all-time high.

View More

Weekly Market Performance – Markets Higher As Stocks Enter New Bull Market

June 15, 2023

The S&P 500 Index finished this week up more than 20% from its October 2022 closing low, marking the start of a new bull market (based on the most widely accepted definition). Leadership this week came from some of this year’s laggards, including small-caps, cyclicals, as well as the equal-weight S&P 500 Index.

View More

The Bulls are Back in Town

June 12, 2023

The bulls are back in town, at least according to the technical qualifier of a 20% advance off a bear market low. There is additional supporting evidence for the S&P 500’s bull market designation, including, but not limited to, the market’s uptrend formed by consistent higher lows and higher highs since October 2022 and the S&P 500’s short-, medium-, and long-term moving averages all appropriately stacked above one another.

View More

Strong First 100 Days a Positive Sign for the Rest of 2023

May 31, 2023

Yesterday was the 100th trading day of 2023, and a productive 100 days for stocks it was. Through that 100th trading day on May 25, about 40% of the way through the year, the S&P 500 Index has gained a solid 8.1% (excluding dividends). That milestone on the calendar seems like a good time to look at what the strong start to the year might mean for the rest of 2023.

View More

Markets Tend to Rally When Rate Hike Cycles End

May 18, 2023

The Federal Reserve’s interest rate hiking cycle may be nearing its end amid signs of receding inflation.

View More

Stock Returns and Recessions Around Inflation Peaks

May 15, 2023

We are coming up on being a full year removed from the peak in inflation next month, measured by the one-year change in the Consumer Price Index (CPI). CPI peaked in June 2022 at 9.1%. Year-over-year inflation has decline every month since, with the most recent reading for April 2023, released yesterday, at 4.9%.

View More

Bonds Historically Provided Consistent Positive Performance After Fed Pauses

May 15, 2023

The Federal Reserve has signaled potential for a downshift in their pace of tightening.

View More

Volatility at Lowest Level Since 2021 - What Could this Mean for Stocks?

April 27, 2023

Implied volatility, as measured by the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), closed yesterday at 16.46, its lowest closing level since mid-November 2021. Today we take a look at possible reasons for the decline in the VIX and what it could mean for short-term stock market returns.

View More

Wading Through Financial Stability Risks: An Action Plan

March 23, 2023

Recent bank failures suggest things are indeed starting to break. However, we don’t think we’re on the brink of a full-blown crisis, as market indicators we follow suggest contagion risks are still currently low. And while we don’t think a full-blown crisis is imminent, financial stability risks have clearly increased, which makes a prudent asset allocation plan a must.

View More

Bonds Are Back… But it May be Bumpy And That is Normal

March 3, 2023

Bond investors experienced the worst year ever for core bonds last year (as per the Bloomberg Aggregate Bond Index), -so the prospects of another year like 2022 could be hard to fathom. The good news is we don’t think we’ll see another year like 2022 anytime soon, but despite the higher starting yield levels, we could see periods of negative returns.

View More

Are Bears Finally Going Into Hibernation?

February 15, 2023

Negative sentiment has been an ongoing theme throughout this bear market. Continuous monetary tightening, surging interest rates and inflation, and slowing growth have been a few catalysts behind the widespread pessimism. However, with stocks staging an impressive comeback since the start of the year, there have been recent signs of bears finally going into hibernation.

View More

Markets Off to a Strong Start in 2023, but Can it Continue?

February 8, 2023

The first month of 2023 is now behind us and it felt very different than 2022. In 2022, the S&P 500 and the Bloomberg U.S. Aggregate Bond Index (“Agg”) both fell and there was much talk of the demise of the “60/40” portfolio (a portfolio of 60% stocks and 40% bonds). But the S&P 500 and the Agg were not only both higher in January, they were both in the top 10% of all monthly returns going back to 1980.

View More

Q4 Earnings Review: Pessimism May Be Overdone

January 19, 2023

Fourth quarter earnings season is underway and probably won’t bring much good news. Lackluster global growth, ongoing profit margin pressures from inflation, and negative currency impacts are likely to translate into a year-over-year decline in S&P 500 Index earnings for the quarter.

View More

Secure 2.0 Top 10 Provisions

January 5, 2023

Congress recently enacted landmark retirement legislation known as Secure 2.0 hat will incentivize individuals to save for retirement, while increasing access to workplace plans. The new law includes a number of provisions intended to benefit individuals as well as small business owners.

View More

2023 Market Outlook

January 5, 20232022 was a dizzying year as markets and the global economy continued to find itself out of balance due to the still present aftereffects of the COVID-19 pandemic and the policy response to it. If 2022 was about recognizing imbalances that had built in the economy and starting to address them, we believe 2023 will be about setting ourselves up for what comes next as the economy and markets find their way back to steadier ground.

View More

Outlook 2023 Edition: Long-Term Perspective on Markets and Economies

December 28, 2022

There’s a new reality taking shape in global markets.

View More

December Down but Not Out

December 15, 2022

Despite the S&P 500 Index starting December with five consecutive days of losses, we think December is down but not out. December often starts slow but historically has been a strong month. There are also some potentially supportive seasonal patterns ahead, such as the Santa Claus Rally, the outlook for January following down years, and the third year of the presidential cycle.

View More

High Inflation and Rising Rates Supported Value in 2022

December 5, 2022

In this week’s Weekly Market Commentary we look at the factors driving value’s 2022 outperformance, the technical trading setup for growth and value, and what to look for in the coming months.

View More

Playbook for a Fed Pivot

November 23, 2022

Recent inflation data has tempered expectations for future Federal Reserve tightening, including a potential peak in the terminal rate near 5.0% in May or June of 2023. While the market has welcomed this news, history suggests the path to a Fed pivot could be volatile for stocks due to elevated inflation and interest rate risk.

View More

Breaking Down the 200-Day Moving Average

November 14, 2022

The S&P 500 has been stuck below its 200-day moving average (dma) for a statistically long time. History suggests the path to recapturing the 200-dma may require more time with additional downside risk. However, after the index has been contained below the 200-dma for extended periods comparable to today, forward 52-week returns for the S&P 500 have historically been bullish.

View More

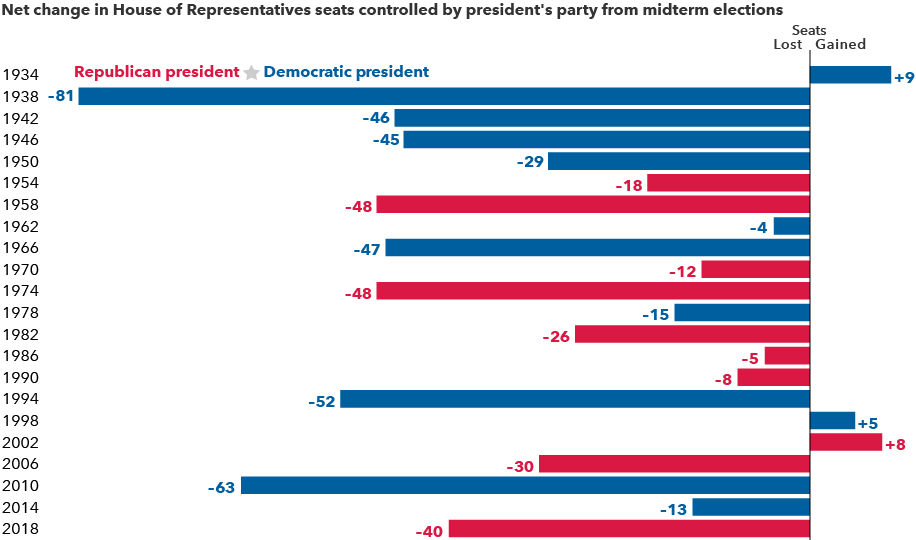

How Midterm Elections May Move Markets

November 9, 2022

Midterm elections are upon us, with Election Day on Tuesday. Republicans are strongly favored to win the House, and the Senate is roughly a tossup. We believe either outcome would be marketfriendly, although the bigger market driver will likely be central banks’ efforts to tame inflation. In this week’s Weekly Market Commentary, we look at why the stock market may respond favorably to the midterm election, whatever the outcome.

View More

Markets Climb on Resilient Earnings and Better-Than-Anticipated GDP

November 1, 2022

Stocks finished higher as Q3 earnings, so far, have come in better-than-expected by market participants. So far, with help from upside surprises in the energy space, S&P 500 earnings are now tracking to a more than 2% year-over-year increase.

View More

Three Things to Know About Recessions: The 3 D's

October 27, 2022

If the U.S. economy enters a recession, the causes and potential outcome will be hotly debated. At LPL Research, our starting point is always looking at history. This week’s commentary will remind us of three things we know about historical recessions.

View More

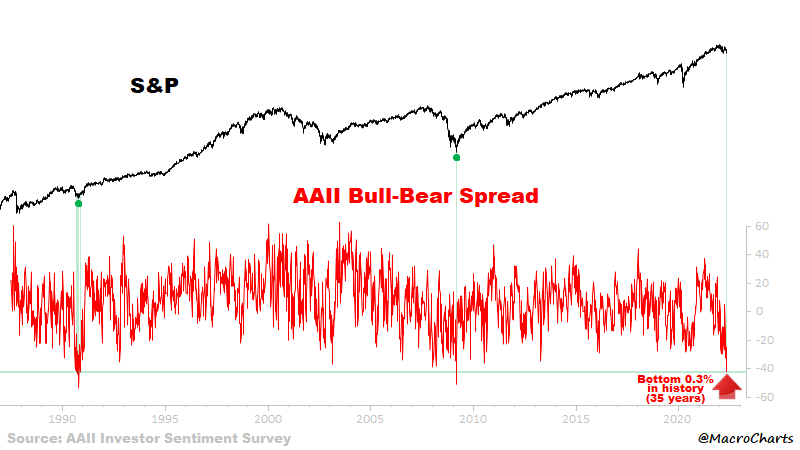

Investor Pessimism Still at Historic Lows

October 18, 2022

The latest weekly data from the American Association of Individual Investors (AAII) showed the percentage of individual investors who are bullish about short-term market expectations at very depressed levels (20.4%), and continued the trend of an extremely elevated proportion of bearish investors (55.9%).

View More

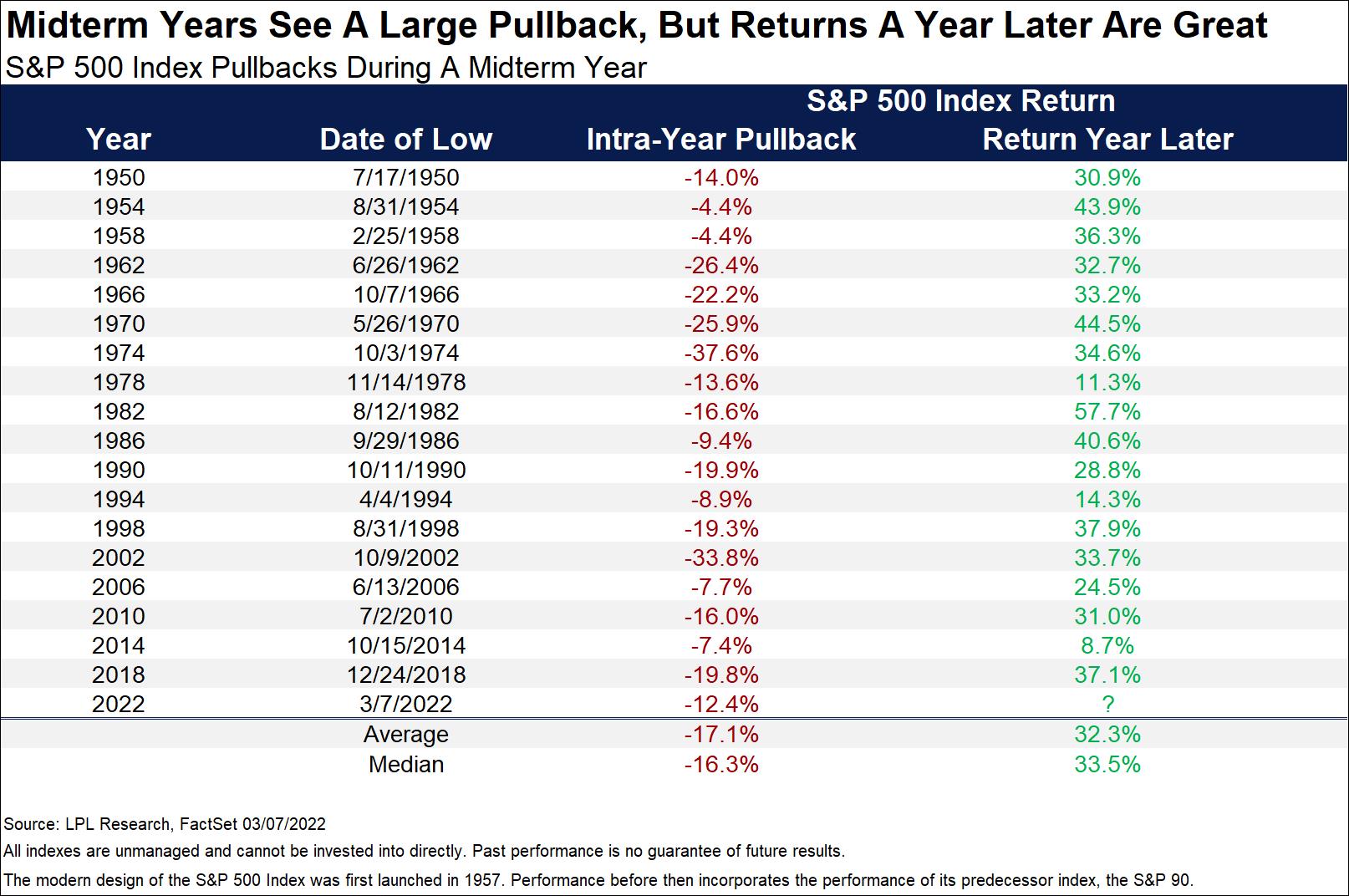

Midterm Year Seasonality Swings Favorable for Stocks

October 10, 2022

With so much focus on the equity bear market, inflation, interest rates, the Federal Reserve (Fed) and rising recession risks, it’s perhaps no surprise that the buildup to the U.S. midterm elections has taken more of a backseat than in prior election cycles.

View More

How Markets Respond to Drawdowns

October 10, 2022

When markets are down, the natural bias is to sell. But looking at history, the more the S&P 500 is down, the better it does in the next year, on average. Like boxing for Eddie Dupris, everything in investing is backwards.

View More

How Long Do Recessions and Bear Markets Last?

October 5, 2022Recessions have been relatively small blips in economic history.

View More

Braving Bear Markets: 5 Lessons from Seasoned Investors

October 5, 2022Stock markets around the world have entered bear territory. In the U.S., the S&P 500 Index has plummeted more than 23%, year to date, as of September 26, 2022. Today, many investors are focused on the likelihood of recession, rising rates and more pain ahead.

View More

Can Midterm Elections Move Markets? 5 Charts to Watch

September 21, 2022

In a year when soaring inflation, the war in Ukraine and a bear market have commanded headlines, the U.S. midterm elections risked becoming an afterthought. But now the election is coming back into focus. And with good reason. Capital Group political economist Matt Miller believes 2022 could be one of the more consequential midterm elections in U.S. history.

View More

Weekly Market Performance - Markets Selloff As CPI Surprises to Upside

September 21, 2022

Markets worldwide suffered losses amid a hotter-than-expected August Consumer Price Index (CPI) print along with negative leaning Q3 corporate announcements. Given Tuesday’s inflation report, market participants are expecting the Federal Reserve to increase interest rates by at least 75 basis points (b.p.) at its meeting next week to take its short-term interest rate to 3.25%.

View More

September's Calendar Cruelty for Stocks

September 12, 2022

"So will this September be another struggle? The combination of peak hawkishness from the Fed and the frustratingly slow pace at which inflation is cooling could continue to weigh on stocks for another month or more." - Jeffrey Buchbinder, CFA, Chief Equity Strategist, LPL Financial

View More

September Seasonals

September 6, 2022

For investors September is often a month to remember but for the wrong reasons. In fact, as shown in the LPL Chart of the Day, September has historically been one of the weakest months of the year for stocks.

View More

Earnings Recap: Still Hanging In There

September 6, 2022

Earnings growth of 6-7% doesn’t sound very exciting, but given the challenges corporate America has faced, we consider the nearly-complete second quarter earnings season a resounding success.

View More

Start of a New Bull Market?

August 17, 2022

Investors cheered the two better-than-expected inflation reports last week, pushing the S&P 500 to 16% above its June 16 low and only 11% below its all-time high. After this rebound, the key question investors are asking is whether this is a bear market rally that will soon fizzle or the start of a new bull market.

View More

The Bulls Are Back In Town?

August 17, 2022

The latest weekly data from the American Association of Individual Investors (AAII) showed a continued increase in the percentage of individual investors who are bullish about short-term market expectations (32.2%), and a continued reduction in the number of bears (36.7%). This puts the spread between the bulls and the bears at -4.5%, still slightly bearish overall but at the lowest level of pessimism since the end of March 2022.

View More

10 Things You Should Know About Inflation

June 15, 2022

10 Things You Should Know About Inflation After decades in hibernation, inflation’s back. Here are the basics about this invisible thief.

View More

10 Things You Can Do If You're Feeling Inflation's Pinch

June 15, 2022

10 Things You Can Do If You're Feeling Inflation's Pinch We’re facing the worst inflation in decades. Here’s how you can lessen its impact on your wallet.

View More

Social Security Benefits for Spouses

June 14, 2022For many, the rules regarding Social Security benefits are unclear, particularly when it comes to spousal benefits. Making matters more challenging is the fact that the rules aren’t the same for those who are married, widowed, or divorced. These examples can help clarify some of the confusion using four scenarios.

View More

6 Charts Focused on the Long Term

June 2, 2022With the S&P 500 Index in correction territory (down more than 10% from the previous peak) while the market faces a number of big threats, including inflation, a hawkish Federal Reserve, soaring yields, and war in Eastern Europe, investor anxiety levels are understandably elevated.

View More

AAII Bull-Bear Spread

May 11, 2022

The AAII US investor sentiment is very negative which has been a contraindication bullish signal.

View More

Is a Recession Coming? | LPL Market Signals

April 27, 2022LPL Research discusses the latest surge in yields and if a recession could be on the horizon.

View More

Five Retirement Points for Five Years Before You Retire

March 28, 2022Midterm Years See a Large Pullback, But Returns a Year Later are Great

March 8, 2022

Midterm years see an average peak to trough correction of 17.1%.

View More

When Fear Runs High, Time to Buy?

March 4, 2022When volatility rears its ugly head, our instinct is to take our money out of the market to safeguard it. However, history shows that rather than giving in to fear, staying invested and buying stocks during volatile times can be beneficial in the long run.

View More

11 Things to Know About Russia and Ukraine

March 4, 2022

Global stock markets are selling off hard after Russian military forces attacked a broad range of targets across Ukraine last night while Russian President Putin vowed to replace Ukraine’s government. What does it all mean for stocks and the economy? “Russia invading Ukraine has added to an already tense year, with investors selling first and asking questions later,” explained LPL Financial Chief Market Strategist Ryan Detrick.

View More

Busting Two Myths: Why Higher Yields And Rate Hikes Aren't Always Bad

January 31, 2022

Lately, we’ve seen two things swirling that some investors think could hurt them down the road. The idea that higher yields and rate hikes are bad is all over the place, but it all might not be so simple. In fact, looking back at history, neither are necessarily true.

View More

LPL's Outlook 2022

December 20, 2021Our resurgent economy grew at over a 6% pace in the first half of the year and is on track for 5% growth for the year when 2021 draws to a close. The current economic recovery, which started in May 2020, benefited from widespread vaccine availability and additional fiscal stimulus. While the economy continues to move forward, we’re still feeling the aftershocks of the COVID-19 Delta variant, whether through elevated inflation, supply chain bottlenecks, or an imbalanced labor market.

View More

Four Keys To Building a Successful Investment Strategy | LPL Street View

December 20, 2021Learn the keys to building a successful investment strategy.

View More

The Most Important Chart in the World

October 12, 2021

And just like that, the calendar turned to October and volatility picked up in a big way, with three consecutive 1% moves for the S&P 500 Index to start the month. As we noted in our October preview, this month gets a bad rap for being a bearish month (it isn’t), but it absolutely owns the title as the most volatile month.

View More

We Don't See Runaway Inflation

October 12, 2021Ryan Detrick, chief financial strategist at LPL Financial, joins “Squawk Box” to discuss the economy and risk of inflation for the U.S.

View More

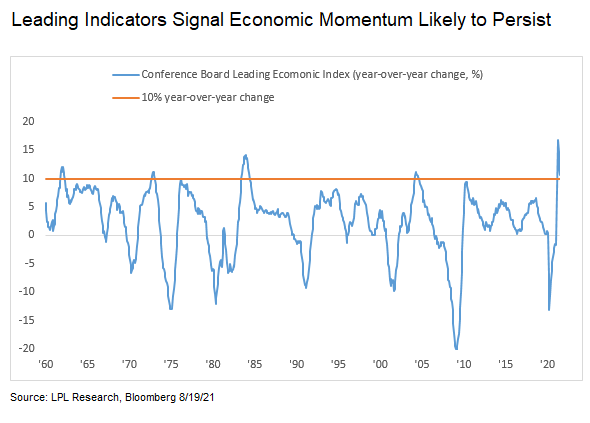

Leading Indicators Forecasting Continued Growth

August 25, 2021

With increased concerns about the Delta variant, high inflation, and recentmisses on economic data, it can be easy to forget that we’re still in the middleof a robust economic recovery and leading indicators continue to support apositive outlook. On Thursday, August 19, the Conference Board released itsJuly 2021 report detailing the latest reading of its Leading Economic Index(LEI), a composite of ten data series that tend to lead changes in economicactivity.

View More

Is It Time For A 5% Pullback?

July 23, 2021

Monday’s big down day was a harsh reminder of how markets actually can produce volatility. It was the worst day of the year for the Dow and only the second drop of 1% or more for the S&P 500 Index in just over two months. As we noted recently in Three Things That Worry Us, there are many reasons to think that after more than a 90% rally (and virtually a double on a total return basis), the S&P 500 could finally be ready for a break.

View More

LPL's Mid-Year Outlook 2021

July 16, 2021The U.S. economy powered forward faster than nearly anyone had expected in the first half of 2021. As we were writing our Outlook for 2021 in late 2020, our economic views were significantly more optimistic than consensus forecasts—but in retrospect, not nearly optimistic enough. Our theme was getting back on the road again and powering forward.

View More

June Swoon?

June 15, 2021

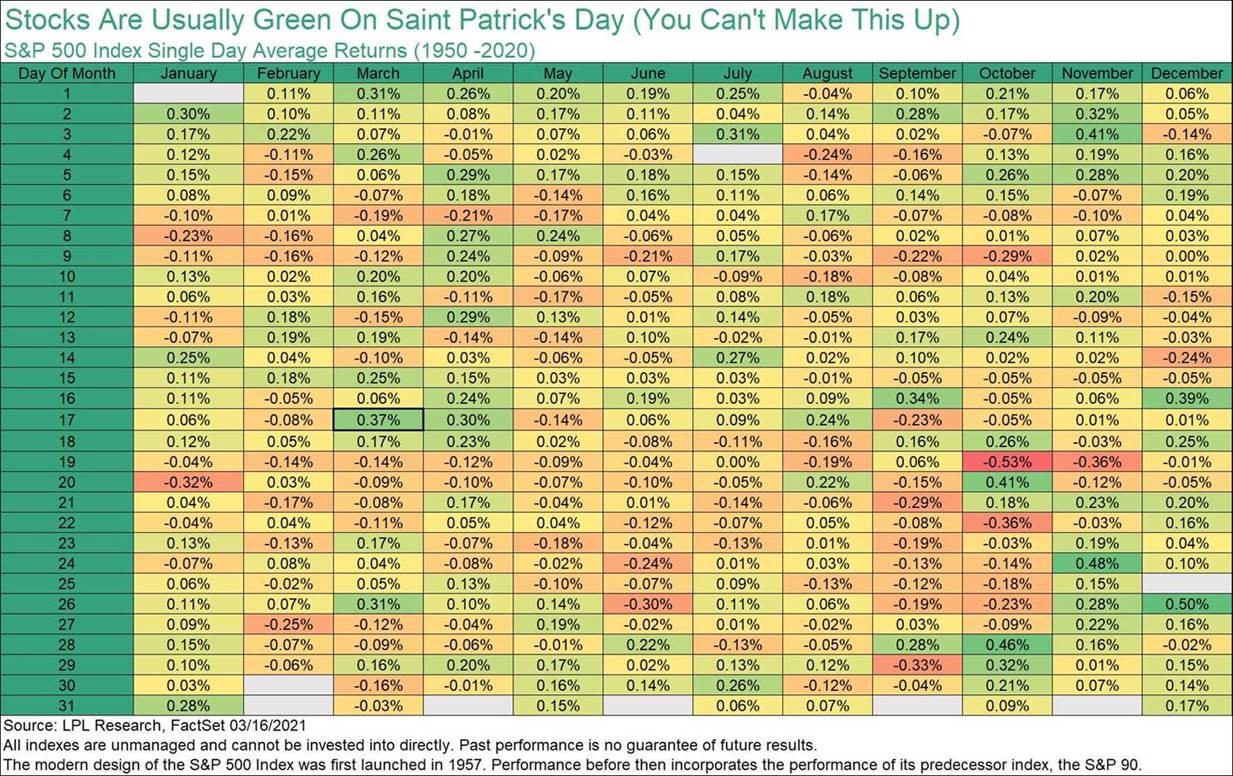

Although there was some notable weakness in the middle of May, the S&P 500 Index was able to rally late in the month to finish with a modest gain. Incredibly, this was the eighth year out of the past nine that stocks gained during in May.

View More

Social Security Spousal Benefits

May 26, 2021

More than 2.3 million Americans currently receive Social Security spousal benefits. The average benefit is almost $800 per month, and some spouses receive significantly more. These valuable benefits can make a big difference in funding retirement for a married couple and might result in higher total benefits, even if both spouses have their own work records.

View More

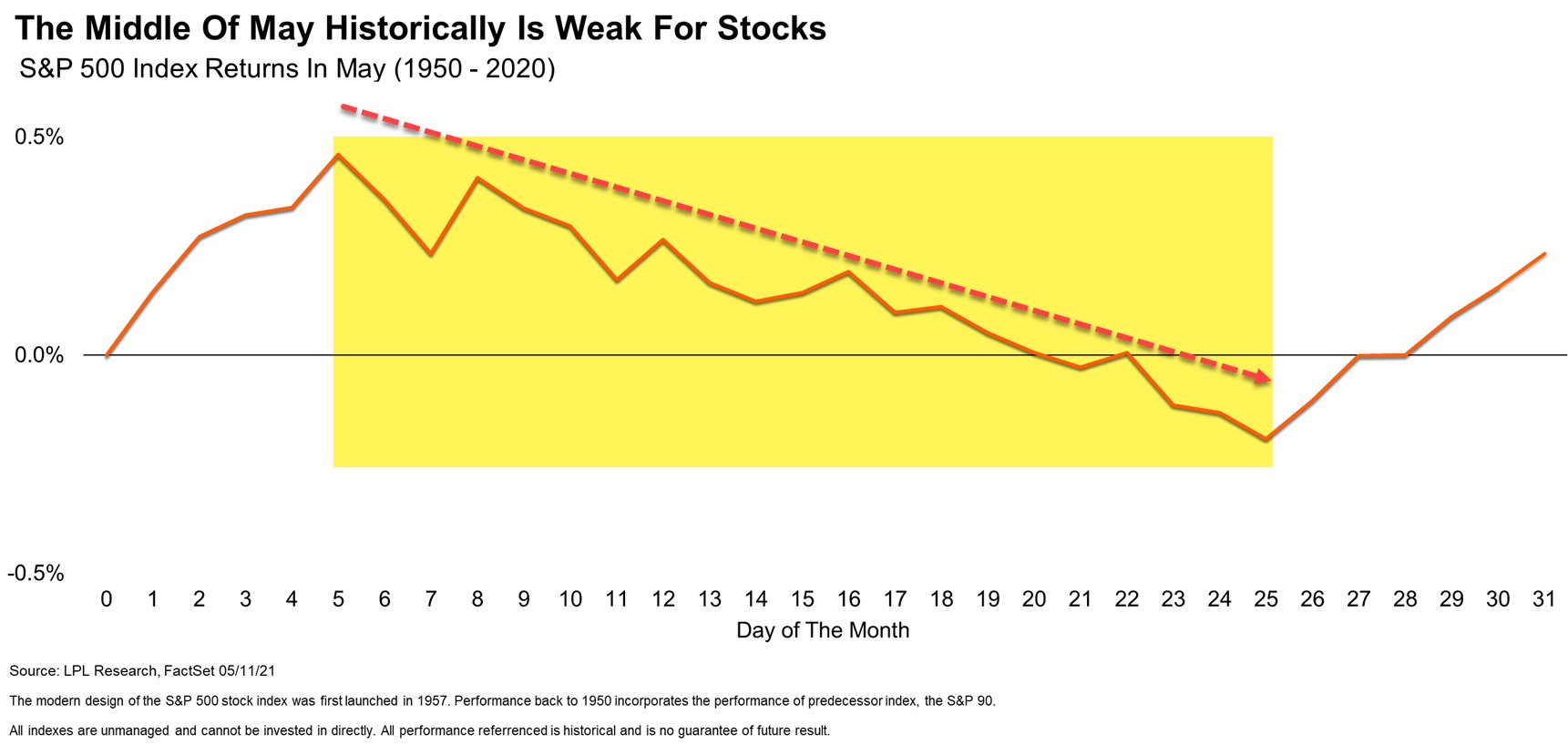

The Middle of May Historically is Weak for Stocks

May 17, 2021

Historically, the middle part of May is when you tend to see the "Sell in May" thing me keep hearing. In other words, the next two weeks could be potentially dicey.

View More

Sequence Risk: Preparing to Retire in a Down Market

April 14, 2021

“You can’t time the market” is an old maxim, but you also might say, “You can’t always time retirement.”

View More

It's Fed Day!

March 18, 2021

Fed Day. The Federal Reserve (Fed) finishes their two-day Federal OpenMarket Committee (FOMC) meeting today with a decision on interest rates and policy statement, followed by a press conference with Chair Jerome Powell.

View More

IRA and Retirement Plan Limits for 2021

February 25, 2021Many IRA and retirement plan limits are indexed for inflation each year. While some of the limits remain unchanged for 2021, other key numbers have increased.

View More

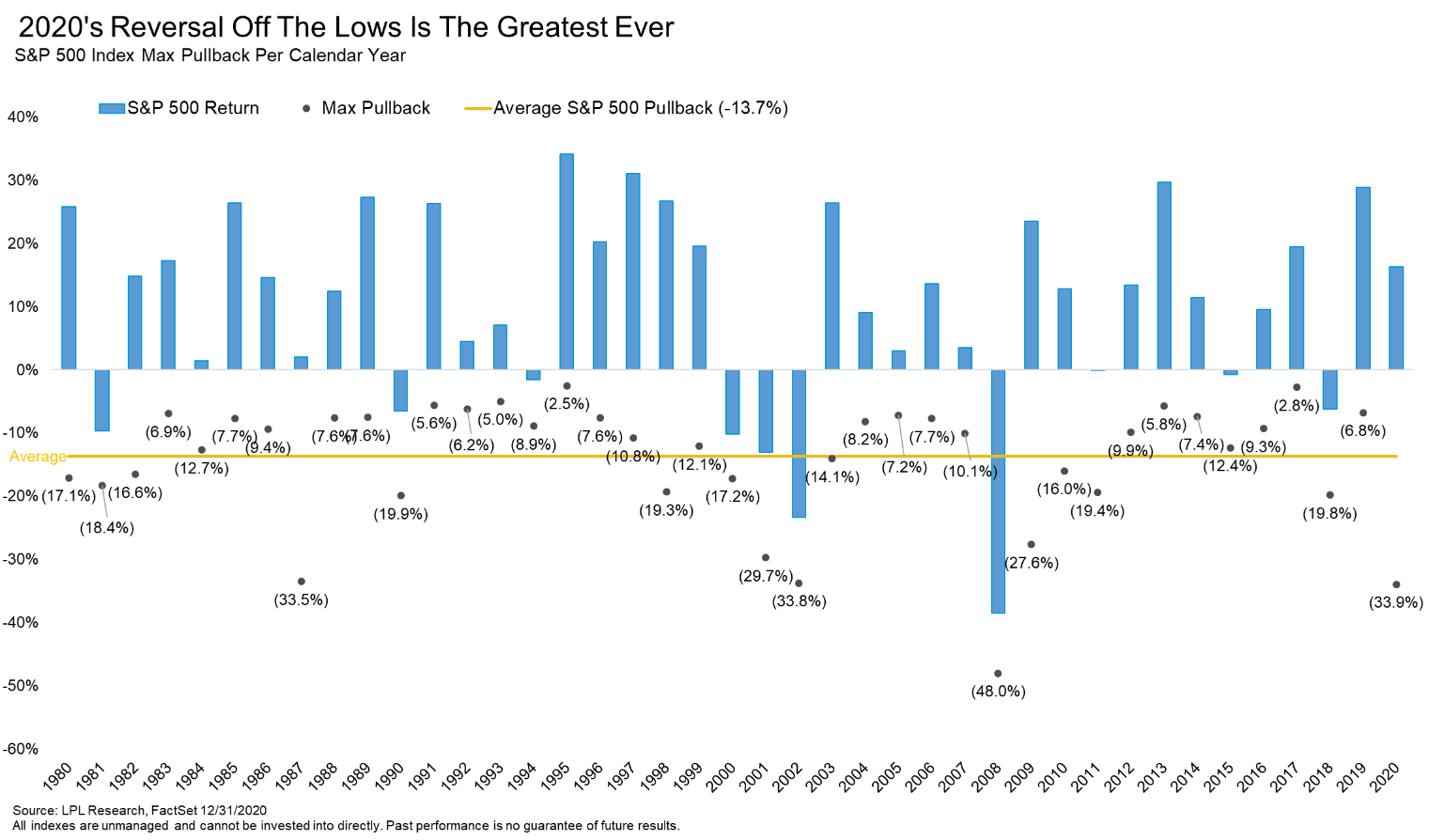

2020 in 20 Charts

February 24, 2021

Well, we can officially say goodbye to 2020. Although there still will be many challenges in 2021, we do see much better times ahead. Just how amazing was it? “2020 will go down in history as the first year to ever be down 30% at one point and still finish in the green,” explained LPL Financial Chief market strategist Ryan Detrick. “We’ve had some wild years for investors, but never one that was quite the roller coaster of 2020.”

View More

The Stock Market's Cost of Admission

February 24, 2021

“One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world.” –Jesse Livermore

View More

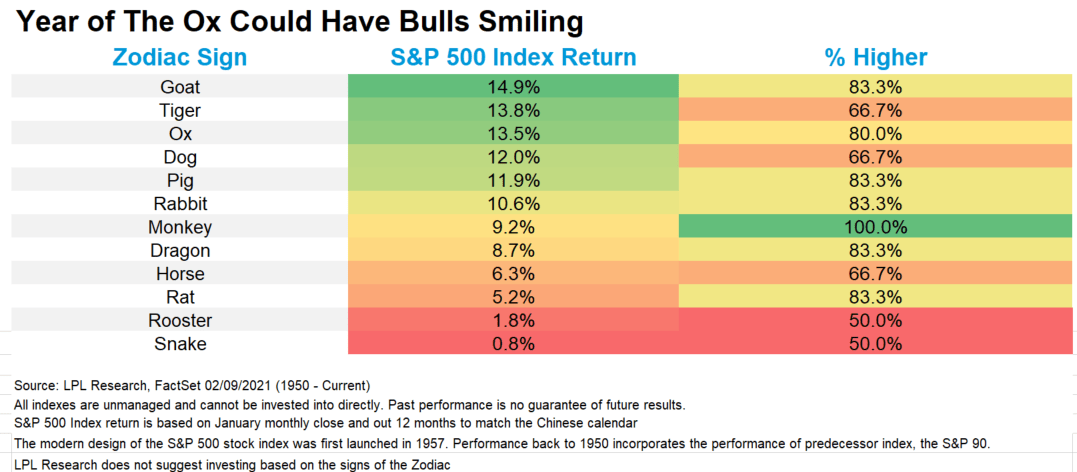

Why Bulls Will Like The Year Of The Ox

February 12, 2021

The Chinese New Year (often called the Lunar New Year) will kick off Friday, February 12, and with it will begin the Year of the Ox. Although we would never suggest investing based on the zodiac signs—itis important to note that the Year of the Ox has historically been quite strong for equities. Not to mention we are saying goodbye to the year of the Rat. Good riddance to the Rat, as the last two years of the Rat were 2008 and 2020, not the best years for many reasons!

View More

Will GameStop Stop the Bull Market?

February 3, 2021“In the short term, the market is a popularity contest. In the long term, the market is a weighing machine.” -Warren Buffett The incredible action from some of the most heavily shorted names has investors everywhere wondering what it all means? GameStop (GME)specifically has taken the country's imagination by storm, as the stock started the year under $20 per share and this morning nearly hit $500.

View More

LPL Financial's Outlook 2021

December 10, 20202020 has been a tumultuous year, and as we near its close, we are pleased to present Outlook 2021: Powering Forward, which outlines our views on markets, the economy, and policy into 2021 and beyond.

View More

Elections Matter, But Not So Much to Your Investments

September 30, 2020Election years can be fraught with uncertainty as developments surrounding the candidates, their platforms, and their predicted effects on the economy and markets dominate the news. But should you let this stream of political information influence how you and I manage your investment portfolio? A lengthy history of empirical research suggests not. Elections matter, just not in all the ways you might think to an investor.

View More

It May Not Pay to Avoid the Market in the Early Days of a New Administration

September 30, 2020History suggests waiting until a new president's policies take shape hinders rather than helps long-term results.

View More

The US Election: Risks and Opportunities

September 16, 2020As we approach the upcoming presidential election, how might the potential outcomes impact the economy and markets?

View More

Say Goodbye to the Shortest Bear Market in S&P 500 History

August 24, 2020The S&P 500's .SPX record closing high on Tuesday confirmed that the coronavirus-fueled bear market of 2020 was by far the shortest ever.

View More

LPL Street View: Let's Talk About Gold

August 13, 2020"LPL Financial Research Chief Market Strategist Ryan Detrick talks about why gold is at all-time highs and we're bullish on gold." -LPLResearch

View More

LPL Financial's Midyear Outlook 2020

July 28, 2020"LPL Research’s Midyear Outlook 2020 provides our updated views of the pillars for investing—the economy, bonds, and stocks. As the headlines change daily, look to these pillars, or trail markers, and the Midyear Outlook 2020 to help provide perspective on facing these challenges now and preparing to move forward together."

View More

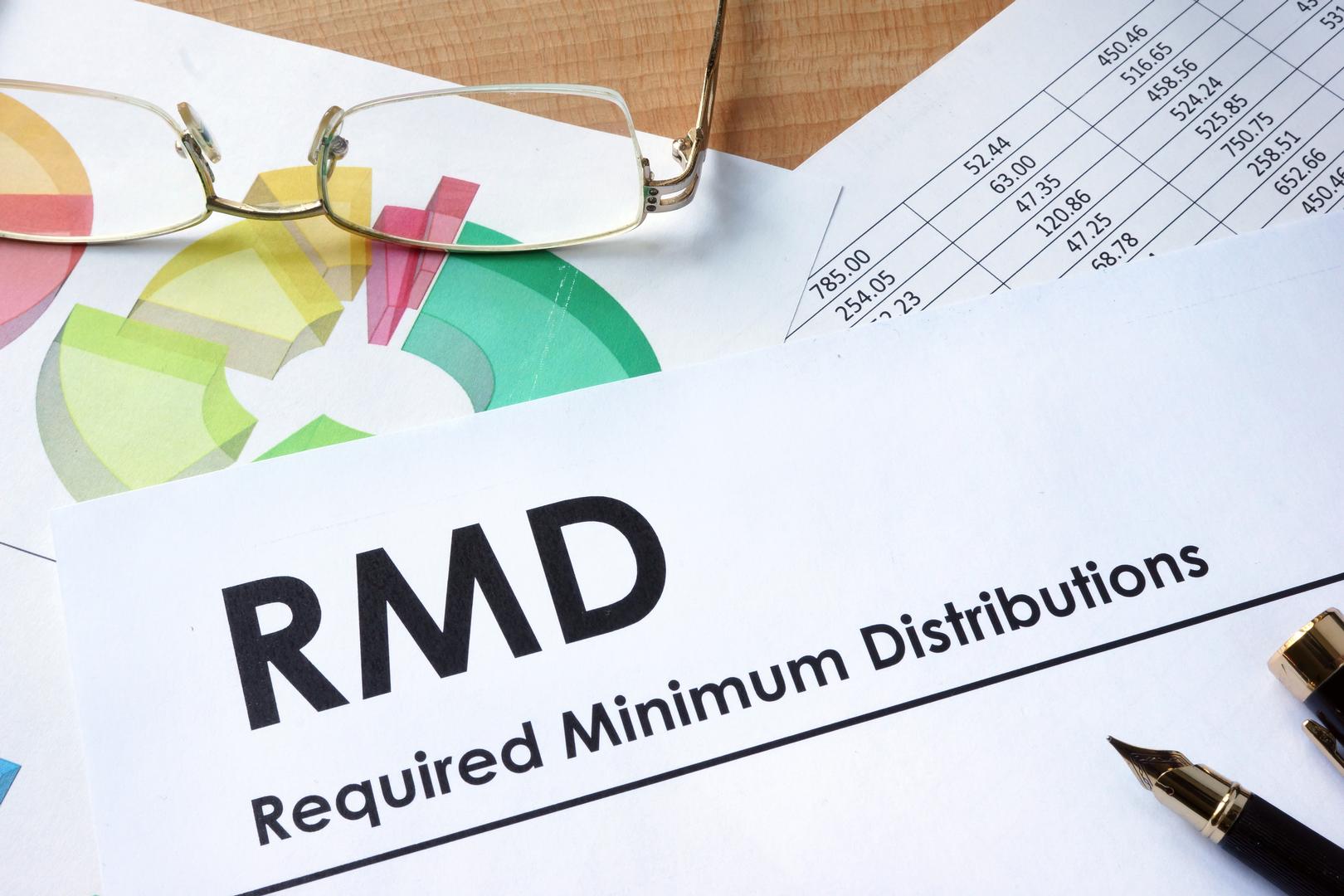

RMD Waiver Expanded for All Investors in 2020

July 24, 2020

In response to the economic challenges posed by the pandemic, the CARES Act introduced a waiver for required minimum distributions (RMD) for owners of IRAs and retirement accounts for 2020.

View More

The Truth About Presidential Elections and the Stock Market

July 2, 2020Politics and investing have always been spoken about in the same breath. Commentators and candidates alike often frame the performance of the stock market as a sort of “barometer” of a president’s policies.

View More

Why Stocks Can Predict the Next President

July 1, 2020Although the fight against COVID-19 continues to dominate the headlines and our thoughts are with those affected, this is an election year and as we get closer to November it will begin to garner more attention.

View More

Michigan Auto Insurance Reform

June 22, 2020

This post will give you information on the Michigan Auto Insurance Reform and how it may affect your health insurance. Your health insurance may vary, so please be sure to check with your agent before making changes to your auto insurance.

View More

Slumping Economy, Surging Stock Market- What's Going On?

June 8, 2020While tens of millions of Americans were losing their jobs, the stock market in April produced its best monthly return in over 30 years. What’s behind this apparent disconnect?

View More

2020 In Charts

June 3, 20202020 is only five months old, but in many ways it is one of the most historic years we’ve ever seen. “2020 went from moving along nicely, to seeing the worst recession in a generation and the fastest bear market ever,” explained LPL Financial Senior Market Strategist Ryan Detrick...

View More

US and China are starting to 'go at it again' but market is shaking it off

June 1, 2020Check out Ryan Detrick, LPL Financial Senior Market Strategist, on Yahoo! Finance. Ryan will discuss jobless claims and outlook for GDP.

View More

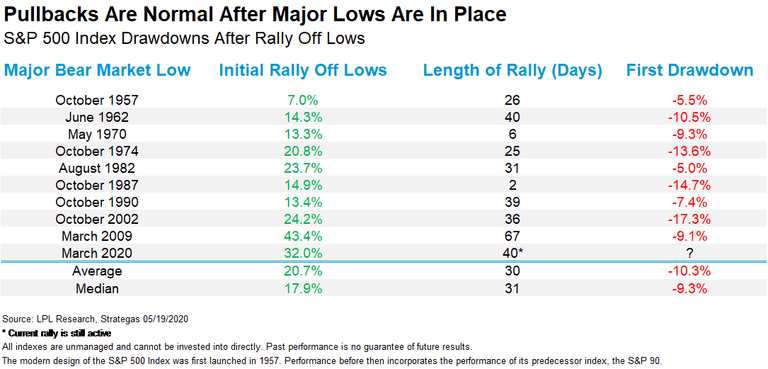

What Happens When the Bear Ends?

May 22, 2020

The incredible rally off the March 23 lows continues for equities, with the S&P 500 Index now up more than 32% in 40 trading days. As impressive as the rally has been, we do have some near-term concerns, as we discussed in Downside Risk Remains...

View More