By Capital Group

Jody Jonsson

Equity Portfolio Manager

A new reality for investors

There’s a new reality taking shape in global markets.

Many commentators are focusing on the rotation from growth to value, but I think that view is too simplistic. Some investors may be hoping for a return to normal after central banks stop raising interest rates and inflation subsides. In my view that’s not the path forward due to several seismic shifts that will likely define the next decade of investing.

From falling rates to rising rates: Inflation is at its highest levels since the early 1980s and, until recently, we’ve had 40 years of declining rates. As rate cycles reverse, the process often takes much longer than anticipated, which leads me to believe that some inflation will likely persist. Consequently, I’m wary of highly leveraged companies. Money isn’t free anymore, so a larger slice of earnings will go to service debt. And companies able to fund their own growth will remain particularly attractive.

From narrow to broad market leadership: The last decade of investing was dominated by a handful of internet-related companies. This overshadowed the fact that you can’t build a new economy without older industries. While digital-first companies are not going away, I think investors will start to place greater emphasis on producers of physical assets. Moreover, I expect broader market leadership to emerge among a variety of companies, which should provide a positive backdrop for stock pickers over indexers.

From global to regional supply chains: The globalization of supply chains is another multi-decade trend adjusting course. For a generation, companies moved manufacturing overseas to cut costs. But the limitations of placing efficiency over resilience are now clear. Growing geopolitical tensions and pandemic-induced disruptions have prompted companies to create supply chain redundancies so that a single breakdown won’t derail an entire operation. Such capital investments may help inspire a renaissance among smartly managed industrial companies.

I could describe additional shifts rocking the economy and markets, but suffice to say we are living through a historic period of change. The outlook has evolved from a decade of sunny skies to darker clouds. That may sound like a pessimistic view, but I see it as an exciting time to be a fundamental, bottom-up investor — unrestricted by geographies, sectors or style boxes — and better equipped to adjust to this new reality of investing.

A new reality for investors Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value

Recessions are inevitable, but the pain won’t last forever

Recessions are painful, no doubt about it. But they are necessary to clean out the excesses of prior growth periods, especially the more or less uninterrupted growth investors have enjoyed over the past decade.

“You can’t have such a sustained period of growth without an occasional downturn to balance things out,” Capital Group vice chair Rob Lovelace noted at midyear. “It’s normal. It’s expected. It’s healthy.”

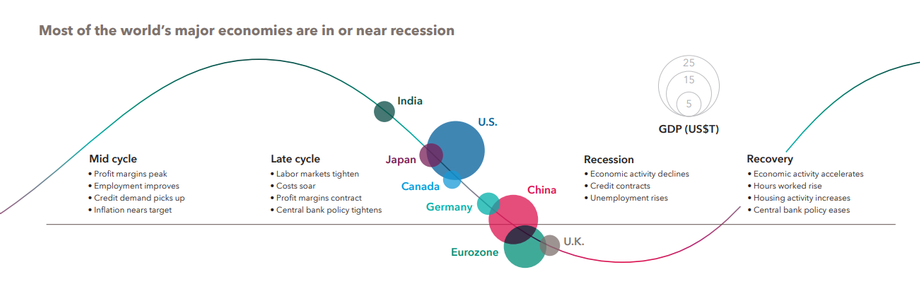

The global economy certainly appears headed in that direction. Europe is likely already in a recession, exacerbated by the war in Ukraine. China’s growth has decelerated essentially to zero, pressured by rolling COVID-19 lockdowns. And the U.S. economy, while stronger than most, appears headed for a downturn as elevated inflation and higher interest rates take their toll.

Capital Group economist Jared Franz expects the U.S. economy to contract by about 2% in 2023 — worse than the post-tech and telecom bubble recession of the early 2000s, but not nearly as bad as the 2008–09 financial crisis.

The important thing to remember, Franz stresses, is that recessions set the stage for the next period of growth.

“Today, the stock market is reflecting a more realistic view that a recession is looming,” Franz adds. “But, historically speaking, stocks also tend to anticipate a brighter future ahead, long before it becomes clear in the economic data.”

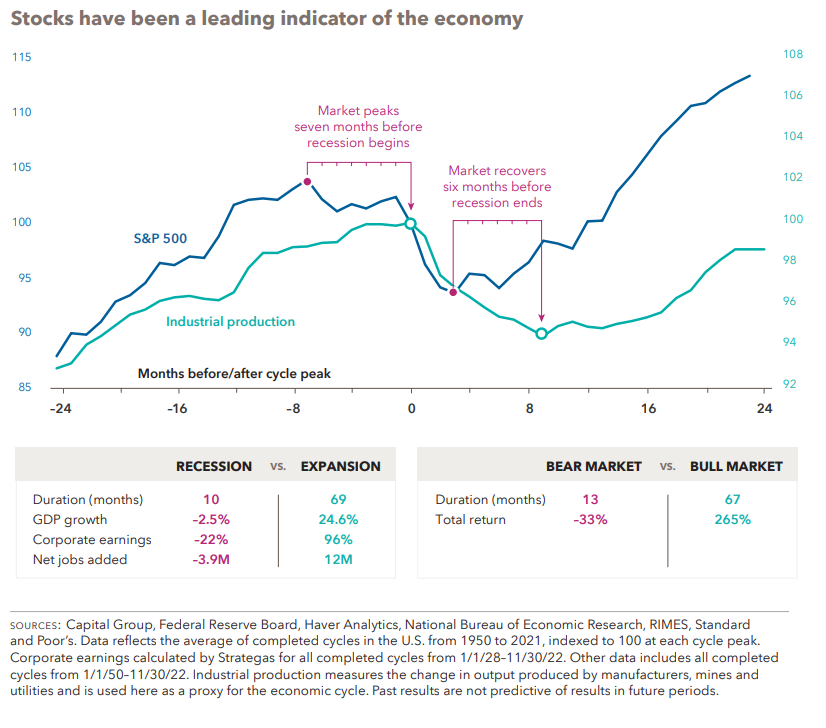

Stocks typically recover before recessions end

Everyone wants to know when the next recession will start and how long it will last. While each recession is painful in its own way, one potential bright spot is that they don’t historically last very long. Our analysis of 11 U.S. cycles since 1950 shows that recessions have ranged from two to 18 months, with the average lasting about 10 months.

What’s more, stock markets usually start to recover before a recession ends. Stocks have already led the economy on the way down in this cycle, with nearly all major equity markets entering bear market territory by mid-2022. And if history is a guide, they could rebound about six months before the economy does.

The benefits of capturing a full market recovery can be powerful. In all cycles since 1950, bull markets had an average return of 265%, compared to a loss of 33% for bear markets.The benefits of capturing a full market recovery can be powerful. In all cycles since 1950, bull markets had an average return of 265%, compared to a loss of 33% for bear markets.

The strongest gains have often occurred immediately after a bottom. Therefore, waiting on the sidelines for an economic turnaround is not a recommended strategy.

“It’s been a difficult year, and the pain may continue,” says Capital Group economist Darrell Spence. “But it’s important to keep in mind: One thing all past recessions and bear markets had in common was that they eventually ended. Ultimately, the economy and the markets should right themselves.”

Bonds should once again offer diversification from equities

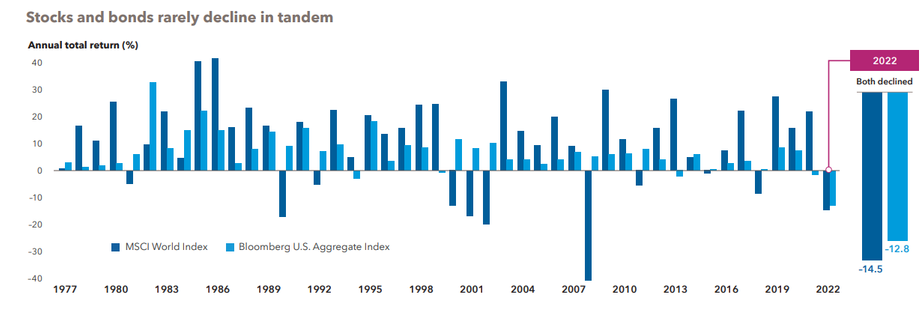

The numbers are ugly — 2022 will go down in history as one of the worst periods for bond returns on record. Big losses have caused investors to question the longheld principle that bonds offer relative safety when stocks fall.

Stocks and bonds rarely decline in tandem in a calendar year, and 2022 was the only exception in the 45-year period dating back to 1977. That’s because the U.S. Federal Reserve, and major central banks globally, hiked aggressively to quell high inflation when interest rates were near zero.

That should change in 2023. Lower inflation reports coupled with growth concerns could allow the Fed to slow down. “I believe we are close to that point,” says Pramod Atluri, fixed income portfolio manager. “Once the Fed pivots from its ultra-hawkish monetary policy stance, high-quality bonds should again offer relative stability and greater income.”

Bonds could offer some relief from volatile equity markets as recession concerns take center stage. “I am seeing more opportunities now that bonds have repriced lower,” says Atluri. “Valuations are attractive so I am selectively adding corporate credit. Bonds now offer a much healthier income stream, which should help offset any price declines.”

In the battle to tame inflation, prepare for a range of outcomes

How persistent will inflation be? And where are interest rates headed?

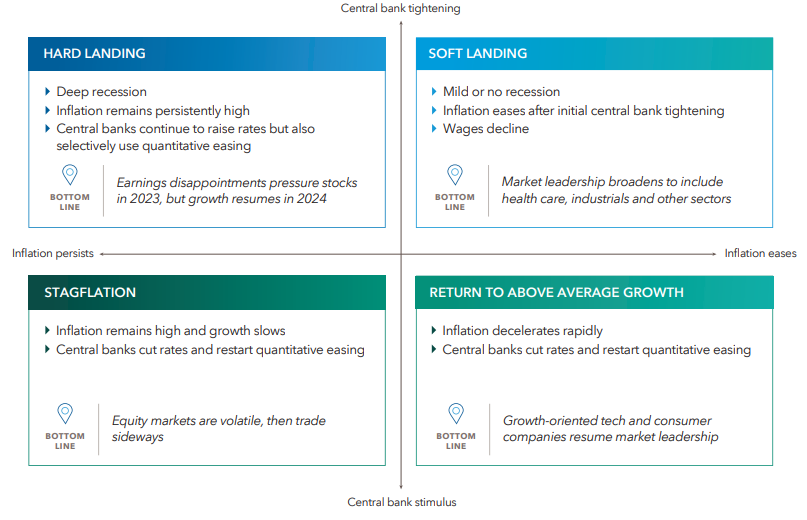

“These are complicated questions that depend on many variables, including investor psychology,” says U.S. economist Jared Franz, who advocates scenario planning in periods of extreme uncertainty. “With central banks around the world following differing paths, we are weighing a range of outcomes rather than committing to a single answer.”

Markets appear to have priced in expectations for a soft landing, but that may be too optimistic. After the Fed announced its fourth consecutive rate increase of 75 basis points in November, Fed Chair Jerome Powell warned that “the ultimate level of interest rates will be higher than expected.”

Higher rates and nagging inflation will likely tip the U.S. economy into a recession in 2023, adds Franz. “Inflation likely has peaked, but it should remain elevated above the Fed’s target level of 2% for an extended period. That means corporate earnings are likely to decline in 2023 as much as 15% to 20%.”

Europe, which is likely already in recession, should see conditions deteriorate further under pressure from energy shortages and the ongoing war, according to Franz. With respect to China, Capital Group economists expect growth to slow sharply before a stimulus-induced rebound in the second half of 2023.

U.S. inflation reached a peak, but the market may be too optimistic on progress

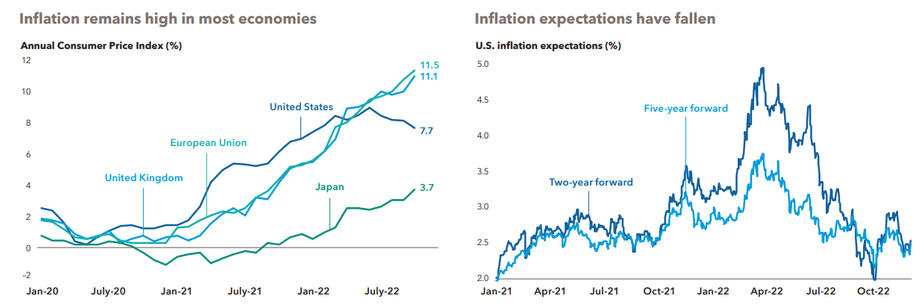

Uncertainty has a name: inflation. Soaring prices have threatened economies globally, with growth for the United States, Europe and Japan expected to stall or contract. As central banks struggle to keep four-decade high inflation under control, demand for items that quickly absorb rate increases, such as housing, has already fallen.

Other pockets of the economy will take more time to cool.

“The impact of rate hikes will unfold over the next several months, likely in the form of higher unemployment, fewer job openings and declining retail sales,” says fixed income portfolio manager Ritchie Tuazon. “The Federal Reserve is likely to slow the pace of rate hikes as the U.S. economy shows signs of weakening, but it also runs the risk of overcorrecting. My concern is that the Fed may have tightened too much.”

There is evidence that inflation has peaked in the U.S. but will remain high. While most of the pandemic-era supply shocks that drove price increases have resolved, the market may be underestimating geopolitical risks and the continuing trend of passing price increases on to consumers, according to Timothy Ng, fixed income portfolio manager. “It’s difficult to see inflation dropping to the Fed’s 2% target in 2023 unless we get a deep recession.”

Look for dividends to account for a larger portion of total returns

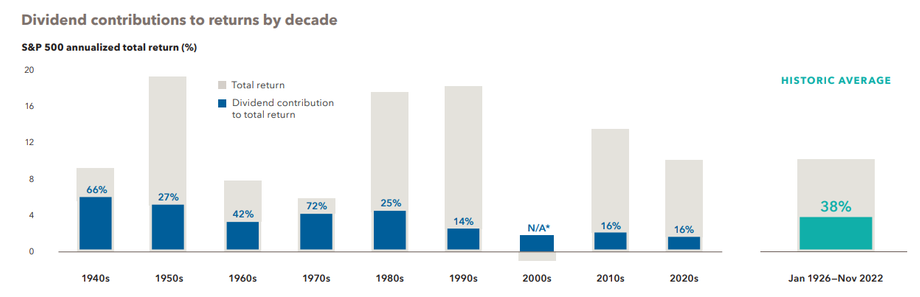

Over the past decade, most investors spent little time thinking about dividends. With U.S. tech and consumer companies generating double-digit returns and dominating the lion’s share of total market return, dividends appeared downright boring.

Today boring is beautiful, according to equity portfolio manager Caroline Randall. “With growth slowing, the cost of capital rising and valuations for less profitable tech companies declining, I expect dividends to be a more significant and stable contributor to total returns,” Randall says.

While dividends accounted for a slim 16% of total return for the S&P 500 Index in the 2010s, historically they have contributed an average 38%. In the inflationary 1970s they climbed to more than 70%. “When you expect growth in the single digits, dividends can give you a head start,” Randall adds. “They may also offer a measure of downside protection when volatility rises, but it is essential to understand the sustainability of those dividends.”

Companies that have paid steady and above-market dividends can be found across the financials, energy, materials and health care sectors, among others. Examples include Zurich Insurance, metals and mining multinational Rio Tinto, biopharmaceutical giant AbbVie, personal care company Kimberly-Clark, and tobacco makers Imperial Brands and British American Tobacco.

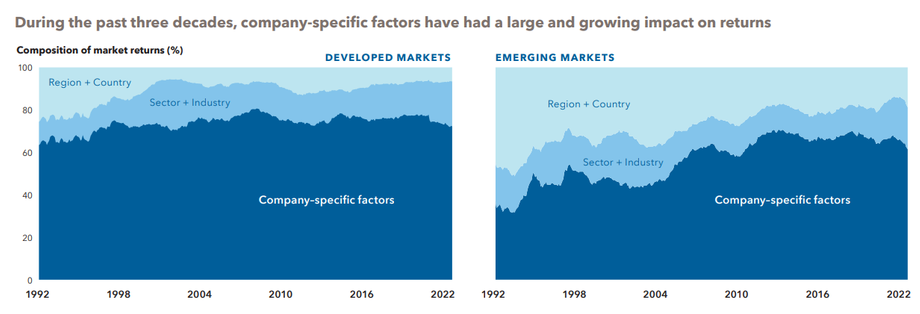

International outlook: Company fundamentals are more important than macro headwinds

There’s no doubt investors have been frustrated in recent years with the persistent lagging returns of international equities. A strong U.S. dollar, weak economies in Europe and Japan, and various troubles in emerging markets have created a cloudy near-term outlook.

However, investors would do well to remember that there’s a difference between top-down macroeconomic views and the fundamental, bottom-up prospects for individual companies. Company fundamentals are driving returns outside the U.S., placing added importance on individual stock picking.

For many multinational companies headquartered in economically struggling areas, national conditions often have little or no impact on revenues, except perhaps when it comes to regulation and taxes.

“In Europe, for example, investing in Airbus has a lot to do with demand for airplanes in the U.S. and China,” says Capital Group portfolio manager Gerald Du Manoir, “while investing in LVMH has a lot to do with U.S. consumer demand for luxury goods.

“In emerging markets,” he adds, “investing in Taiwan Semiconductor Manufacturing has a lot to do with global demand for computer chips. Granted, the outlook for some economies doesn’t look too compelling right now, but I feel confident that we can still find promising companies in Europe, Japan and emerging markets to populate our investment portfolios.”

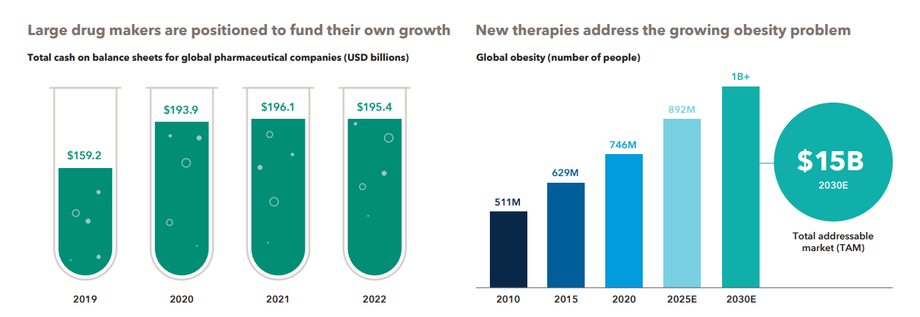

Health care may lead the next bull market

New market leadership often emerges at the end of a bear market. With the cost of capital soaring, companies with strong, reliable cash flows are favorably positioned to lead the next recovery.

Consider the health care sector, which features innovative pharmaceutical companies that are well capitalized and hold pricing power. Select drug makers can use near-term profitability to fund acquisitions and other growth strategies. That’s especially important when rising rates may limit a company’s ability to fuel their growth with debt.

“I don’t know for certain that the health care sector will lead the next bull market,” equity portfolio manager Diana Wagner explains. “But the best managed of these companies could emerge as market leaders.”

Recent investments in drug discovery are resulting in new ways to tackle major problems like obesity. By 2030 it is estimated that over one billion people worldwide will suffer from obesity, which is linked to cardiovascular disease, diabetes and kidney failure. Companies like Novo Nordisk and Eli Lilly have invested heavily in therapies with the potential to reduce a patient’s body weight by as much as 20% to 25%.

“We have entered a golden age of drug development that may vastly improve quality of life for people,” adds Wagner. “This is an exciting time to invest in health care. Few drugs will achieve blockbuster success, however, so selective investing is crucial.”

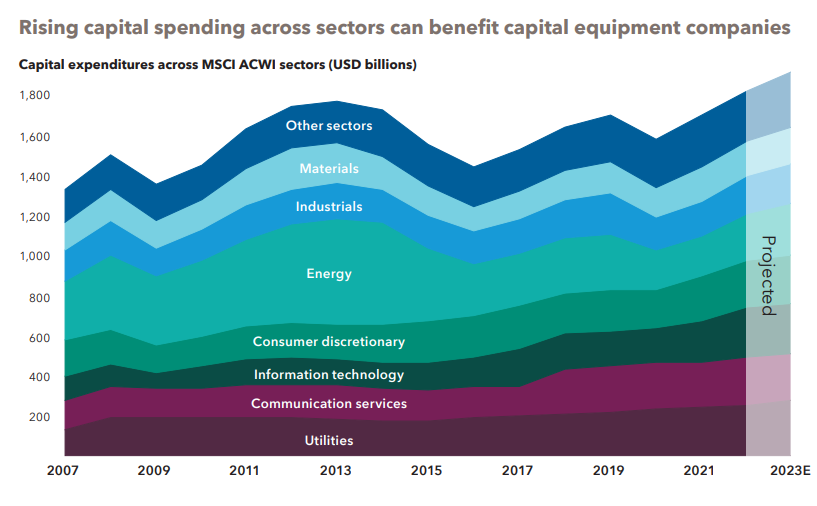

Capital spending super-cycle could power an industrial renaissance

Today’s biggest challenges may have a silver lining: They appear to be setting the stage for a capital investment super-cycle that could drive opportunity for capital equipment companies, lower U.S. energy costs and help revive American manufacturing.

Years of globalization have led to underinvestment in machinery, plants and other capital projects. “You have an aging factory footprint behind the manufacturing sectors of most developed markets,” says Gigi Pardasani, an equity investment analyst who covers U.S. large-cap industrials.

In addition, the transition to renewable energy and greater energy security is generating opportunities for companies that invest aggressively.

“Capital spending has traditionally been looked at negatively,” Pardasani says. “But investments to modernize the power grid, make buildings and factories more efficient, and develop battery technology could boost long-term earnings growth for well-managed companies.”

This billions of dollars in spending also reflects revenue growth potential for capital equipment leaders such as Rockwell Automation; battery and energy storage developers like Lockheed Martin and Tesla; electrical equipment makers like Siemens, ABB and Schneider Electric; and equipment providers to the energy and mining industries like Caterpillar and Baker Hughes.

“This investment cycle can have broader benefits for U.S. manufacturing as significantly lower energy costs over the long term can give American manufacturers a competitive edge, notes Pardasani. “I can see ‘Made in the USA’ becoming a byword for growth again.”

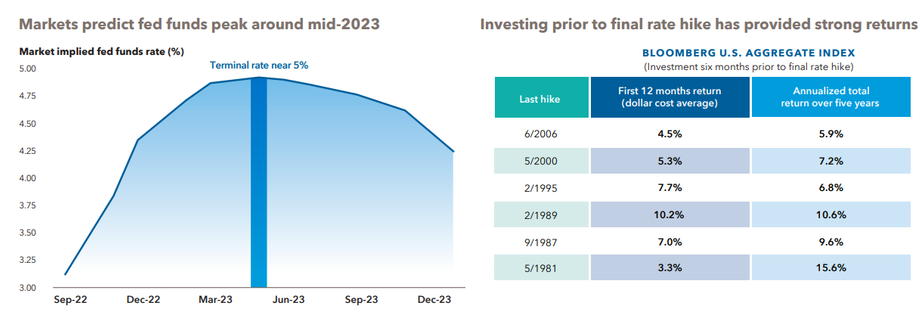

Bond investing before rates peak has provided strong returns

Interest rate turmoil hit bonds hard in 2022. But with the Fed expected to end its hiking cycle in mid-2023, investors are faced with two options: sit on the sidelines or invest.

“I think we will get peak interest rates of around 5%, so the Fed is now close to the end of its tightening cycle,” says fixed income portfolio manager Pramod Atluri. Historically, investing prior to the final rate hike has paid off. In the last 40 years, there were six hiking cycles. Purchasing bonds regularly for a year starting six months prior to the last Fed rate hike in each of those cycles would have returned a range of 3.3% to 10.2% in the first 12 months. Longer term, that year-long investment would have provided a five-year annualized total return that spanned from 5.9% to 15.6%.

“As active managers we aim to purchase bonds with good prospects using fundamental research while also accounting for macroeconomic conditions,” says Atluri. “Markets move fast. I’d rather be early than late when it comes to positioning the portfolios I manage.”

That’s why a consistent investing plan can help investors avoid missing out on attractive bond income opportunities.

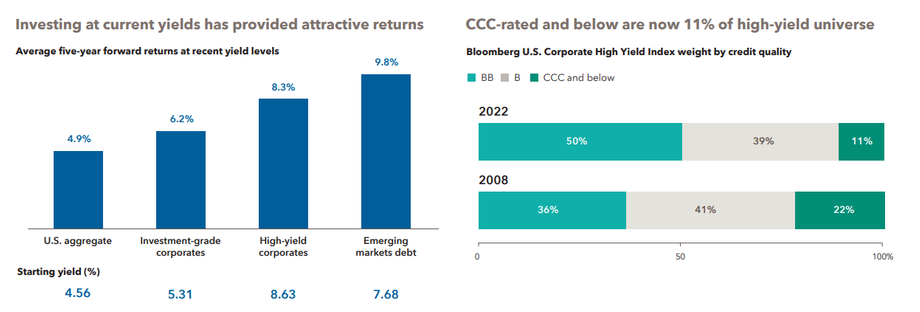

Income is back in fixed income

High inflation and hefty rate hikes by the Fed have given rise to a bond market rout. While painful, these losses can set the stage for higher income down the road. The yield on 10-year U.S. Treasury bonds climbed to 4.27% in October, the highest level since June 2008. Yields, which rise when bond prices fall, have soared across sectors. Over time, income levels should increase since the total return of a bond fund is made up of price changes and interest paid — and the interest component is now much higher.

One surprising element has been the resilience of consumers. Consumer spending accounts for roughly 70% of the economy, and spending has been robust.

“This has helped keep corporate balance sheets in pretty good shape,” says fixed income portfolio manager Damien McCann. “But I expect credit quality to weaken as the economy slows. In that environment, I prefer defensive sectors such as health care over homebuilders and retail.”

High-yield bonds are relatively well positioned for an economic slowdown as bond prices have already declined sharply as rates rose. An uptick in defaults, which markets have already priced in, could still increase in a deep recession.

“We went through a significant default cycle with the pandemic,” says David Daigle, fixed income portfolio manager. “The underlying credit quality of the asset class has improved markedly since 2008.”

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. While not directly correlated to changes in interest rates, the values of inflation linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch, as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specific maturity, liquidity and quality requirements. Bloomberg U.S. Corporate High Yield Index covers the universe of fixedrate, non-investment-grade debt.

JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities. JP Morgan Government Bond Index — Emerging Markets (GBI-EM) Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. The 50%/50% JP Morgan EMBI Global/JP Morgan GBI-EM Global Diversified blends the JP Morgan EMBI Global Index with the JP Morgan GBI-EM Global Diversified Index by weighting their cumulative total returns at 50% each. This assumes the blend is rebalanced monthly.

MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. MSCI World Index is a free float-adjusted market capitalization-weighted index designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States. MSCI Emerging Markets Index captures large- and mid-cap representation across 27 emerging markets (EM) countries. MSCI World Pharmaceuticals is a subcomponent of the MSCI World Index and only contains companies within the pharmaceuticals industry.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.jpmm.com/research/disclosures.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

American Funds Distributors, Inc., member FINRA.