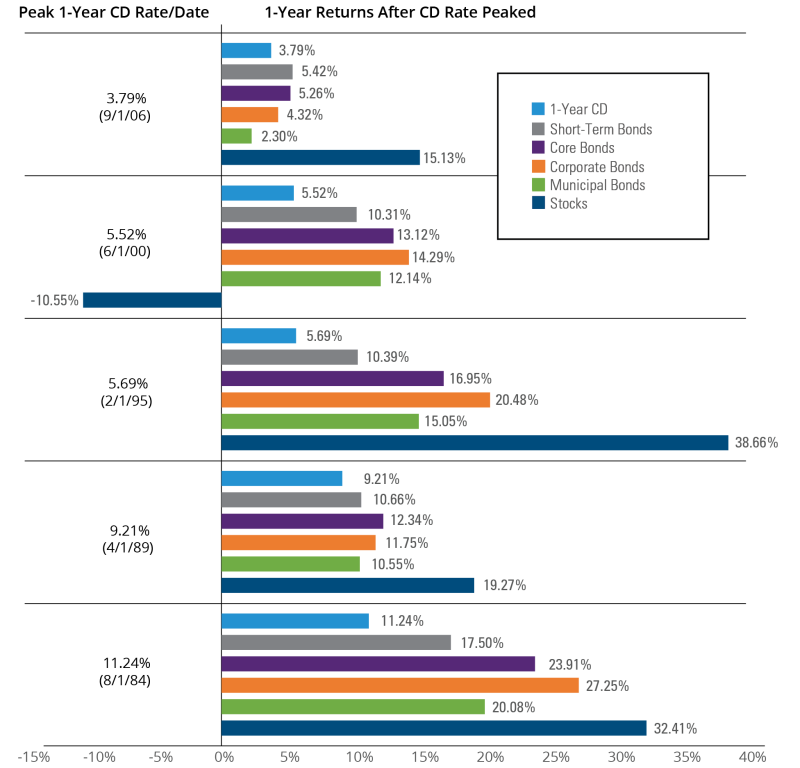

It’s easy to see why CDs are such a tempting investment today. With their relative safety and the most attractive rates in years, some above 4 or 5%, it seems like there’s not much to lose. However, you could end up missing out on even greater returns: When 1-year CD rates peaked in the past, their returns were outpaced by most asset classes during the following year. The chart below doesn’t factor in the impact of inflation and taxes, either, which would also reduce returns.

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. CD rates based on previous peaks in national average rates. See back page for representative index definitions. Source: Morningstar, 8/23.

As with any investment, there are relative risks to be considered. Cash or cash equivalents, such as money-market funds or CDs, involve the least amount of risk as well as the least potential return, generally speaking. Short-term bonds usually offer higher potential yields than cash equivalents and are also typically less sensitive to interest-rate movements than other bonds or fixed-income securities.

Bonds tend to carry greater risk than cash equivalents, including credit risk, the risk that a bond’s lender may be unable to make interest or principal payments on time. Bonds with longer maturities (e.g., 10 or more years) can offer higher returns but can lose value when interest rates rise, known as interest-rate risk.

Bonds are also subject to call risk if the lender chooses to pay off the bond early, which could deprive investors of potential interest income. When rates are falling, lenders sometimes choose to pay off bonds ahead of maturity in order to reissue bonds at lower prevailing rates.

With all this in mind, take a minute to consider your time horizon and financial goals before you sign up for a new CD or automatically rollover an existing one. Is a CD still the most appropriate use of your money to reach your goals? Or would bonds, stocks, or a combination of investments better serve your needs for the long term?

Important Risks: Investing involves risk, including the possible loss of principal. • CDs are insured by the FDIC, offer a ?xed rate of return, and are generally designed for short-term savings needs. The principal value and investment return of investment securities (including mutual funds) are subject to risk, will ?uctuate with changes in market conditions, are generally considered long-term investments, and may not be in the best interest of all investors. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.

12-Month CD rates proxied by Bankrate’s 12-month CD national average. Short-term bonds are represented by Bloomberg US Govt/Credit 1-3 Year Index, an unmanaged index comprised of the U.S. Government/Credit component of the U.S. Aggregate Index. Core Bonds are represented by the Bloomberg US Aggregate Bond Index, which is composed of securities from the Bloomberg Government/Credit Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index. Corporate Bonds are represented by the Bloomberg US Corporate Bond Index, which covers all publicly issued, fixed rate, nonconvertible, investment grade debt. Municipal Bonds are represented by the Bloomberg Municipal Index, which isdesigned to cover the USD-denominated long-term tax exempt bond market. Stocks are represented by the S&P 500 Index, a market capitalization-weighted price index composed of 500 widely held common stocks.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice.

CCWP136 3066169